Dow Jones Price Outlook:

- The Dow Jones traded modestly higher following the Fed’s interest rate decision Wednesday

- Upbeat GDP forecasts might fuel a gradual transition from tech into other sectors, benefiting the Dow

- DailyFX Education Summit: Trade Your Market

Dow Jones Forecast: Upbeat FOMC Projections Might Broaden Stock Rally

The Dow Jones climbed slightly higher following the Fed’s September rate decision in which the Federal Open Market Committee kept rates unchanged, as expected. In what was perhaps less expected, the central bank raised a number of economic forecasts from unemployment expectations to growth projections. The upward revision, while encouraging, was joined by commentary that would suggest the Fed is expecting widespread economic disruption until a vaccine is widely available.

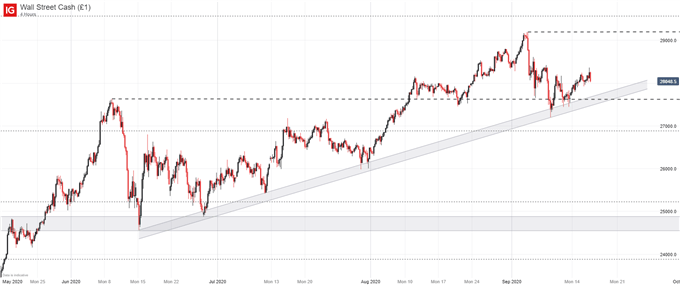

Dow Jones Price Chart: 4 - Hour Time Frame (May 2020 – September 2020)

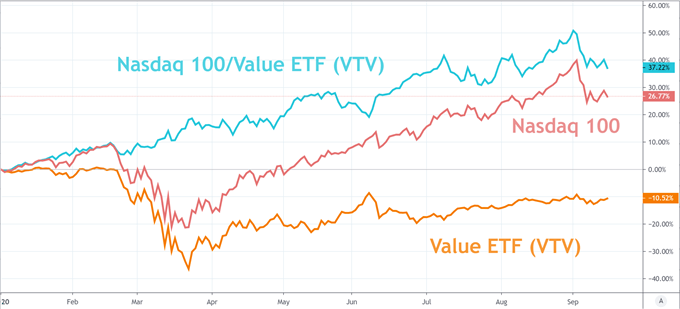

Either way, lower unemployment and higher growth expectations might allow more traditional businesses, like those outside of technology, to rebound more quickly than what was originally believed. Since the recovery rally has been led in large part by the Nasdaq 100 and the FANGMAN group, signs that a broader recovery could occur ahead of schedule might see a slight rotation from technology into sectors like consumer discretionary, industrials, energy and value.

With that in mind, the Dow Jones may enjoy a slight boost compared to the Nasdaq, allowing traders the opportunity to reduce the gap between the two indices. That said, the findings of the Fed do not necessarily make technology stocks less attractive, but they might provide alternatives in a market that has had its focus narrowed for months.

Will Tech Stocks Continue Charge or Will Other Sectors Pick up the Slack?

Created in TradingView.

Consequently, I am hesitant to suggest an immediate transition into value stocks at the expense of technology stocks, but I do believe the Fed’s projections make such a rotation slightly more likely. In the meantime, traders should look for confirmation of such a convergence in the ratio between the sectors.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX