NASDAQ, ASX 200, STRAITS TIMES INDEX OUTLOOK:

- The Nasdaq Composite retraced from the all-time-high as Fed minutes disappointed traders

- The ASX 200 and the Straits Times Index are set to sink with the broader Asia-Pacific markets

- The US Dollar Index (DXY) rebounded. Treasury yields rose across maturities.

Nasdaq Index Outlook:

The Nasdaq Composite fell from its record high following disappointing Fed meeting minutes, in which the central bank painted a challenging picture of the economic recovery while refrained from taking immediate control of the Treasury yield curve. The US Treasury yield curve rose across all maturities, leading to a surge in the US Dollar Index. As the USD tends to exhibit negative correlation with the US stock market, shares on the Wall Street fell from their all-time highs. Furthermore, weakness in equities boosted demand for haven-linked assets such as the US Dollar.

The release of the weekly US jobless claims will be focused on later today, as investors are scrutinize a recovery in the jobs market. Unemployment claims have fallen for a third consecutive week through to the 13th of August. A lower-than-expected jobless claims figure may further underpin the US Dollar’s strength.

Sector-wise, all of the eleven S&P 500 segments ended lower on Wednesday, dragged by rate-sensitive real estates (-2.02%), energy (-1.16%) and consumer staples (-0.74%).

S&P 500 Index Sector performance 19-8-2020

Source: Bloomberg, DailyFX

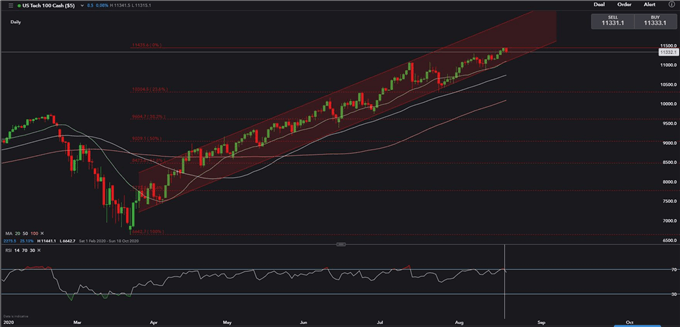

Technically, the index is riding an ascending trend (chart below), with its 20-, 50- and 100-Day Simple Moving Average (SMA) lines trending upward. The RSI indicator has retraced from an overbought level of 71 to 62, suggesting a technical pullback is likely under way. Immediate support levels in the Nasdaq could be found at around 11,090 -the 20-Day Simple Moving Average (SMA), followed by 10,730 – the 50- Day SMA.

Nasdaq Index – Daily Chart

ASX 200 Index Outlook:

Australia’s ASX 200 stock benchmark is likely to decline on Thursday, following soft leads from the Wall Street. The index may find strong support at 6,100 – the upper bound of the ‘Ascending Triangle’ that it broke above recently. The previous resistance zone has now become a meaningful support level.

New Covid-19 cases in Australia have hit a one-month low yesterday, registering a total of 228 new cases in the past 24 hours. The majority of the new infections are found in the Victoria region, while four out of the eight states registered zero new infections. The encouraging news may underpin market confidence today.

ASX 200 Index – Daily Chart

Straits Times Index Outlook:

Singapore’s Straits Times Index (STI) may face some headwinds as US markets fell alongside a stronger US Dollar. As the US Treasury yield curve steepened, Singapore’s real estate and REITs sector may be under the pressure. Rising yields, on the other hand, may be good news for the banking stocks.

Technically, the STI has likely formed a ‘Descending Triangle’ in its daily chart. The overall trend remains bearish-biased, and volume wasn’t encouraging these past few weeks. An immediate support level could be found at 2,500.

Straits Times Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter