Dow Jones, Nasdaq 100, S&P 500 Price Outlook:

- The Dow Jones, Nasdaq 100 and S&P 500 all closed in the red as yields popped and gold stumbled

- Another lower close for the Nasdaq marks the third consecutive daily loss, the first such streak since March

- Will the selection of Kamala Harris tangibly impact markets or was the selloff merely coincidental?

Dow Jones, Nasdaq 100, S&P 500 Forecast: Stocks Slip As Biden Announces VP

The Dow Jones, Nasdaq 100 and S&P 500 fell sharply into the close to round out an unusual day of price action. Slipping gold and silver prices, a US Dollar whipsaw and rising yields were some of the other notable developments, all of which took place earlier in the session. The catalyst behind these moves was widely argued, but an announcement from Democratic Presidential nominee Joe Biden may take center stage heading into the latter half of the week.

In a Tweet shortly after the market close, Mr. Biden announced California Senator Kamala Harris as his Vice President pick, despite their clashes in prior debates. While the role of the Vice President is typically limited, Wall Street may have reservations about some of the policy Harris intends to pursue if elected. Tax cut rollbacks and a new tax levied on financial trading transactions are two of the most prominent proposals that could ruffle feathers on Wall Street.

Since some Americans believe, if elected, that Biden will quickly step aside to allow Harris to take the helm, her policy may fall under greater scrutiny than is normal. Regardless, election night is some distance away so both candidates and their running mates will have ample opportunity to further flesh out their economic policy plans as well as their tax intentions. Thus, it is too early to say with certainty that the declines are due to Harris on the Biden ticket, but a follow-through in the days ahead could begin to provide evidence for the argument.

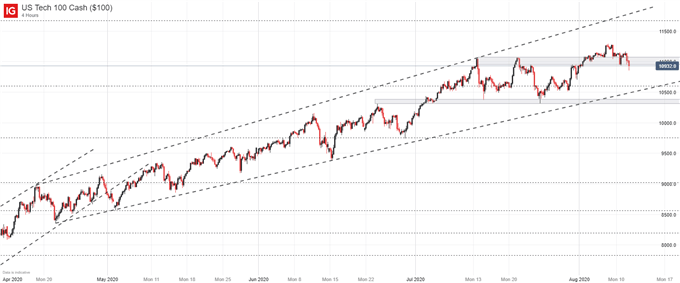

Nasdaq 100 Price Chart: 4 – Hour Time Frame (April 2020 – August 2020)

Either way, the Nasdaq 100 stands on precarious footing above an area that has influenced price previously. Teetering above 10,900, a daily close beneath the level could open the door to further losses, so the technical landscape is rather tenuous. If broken, the subsequent support may materialize at confluent support around 10,600. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX