NIKKEI 225, ASX 200, STRAITS TIMES INDEX OUTLOOK:

- Nikkei 225 index rose in early hours before coming off to 22,400, remaining in a rangebound

- ASX 200 index let go earlier gains and consolidated around 6,040

- Singapore’s Straits Times Index rose for a third day after strong bank earnings

Nikkei 225 Index Outlook:

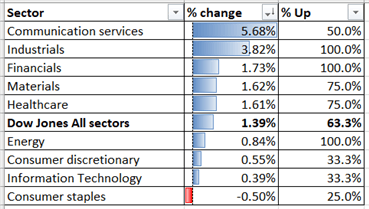

The Nikkei 225 index opened mildly higher on Thursday but failed to maintain its upward momentum. This came in contrast to an upbeat US trading session as the Dow Jones index finished 1.39% higher. Sector-wise, ten out of eleven sectors ended in positive territory, led by communication services (+5.68%) and industrials (+3.82%). Defensive consumer staples (-0.50%) was underperforming.

Asia-Pacific markets today are facing a string of key macroeconomic events. The Reserve Bank of India is expected to cut rates. Thailand and Taiwan are going to release CPI data. The Philippines saw a -16.5% y/y contraction in second-quarter GDP, much worse than the -9.4% estimate. South Korea’s current account balance printed $6880 in June versus $2286 prior.

Dow Jones Sector performance 5-8-2020

Source: Bloomberg, DailyFX

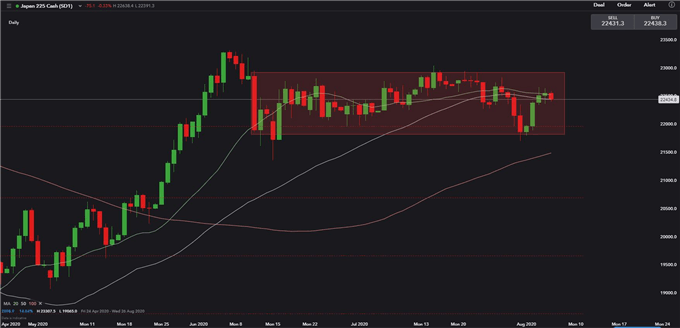

Technically, the Nikkei 225 index is trading in a tight range between 21,800 to 22,900 over the past two months. It has failed to break the upper ceiling of this range-bound zone. Its 20- and 50-Day Simple Moving Averages (SMAs) lines are likely becoming immediate resistance levels. Positive catalysts may be needed for the index to move upward to attempt a breakthrough

Nikkei 225 Index – Daily Chart

ASX 200 Outlook:

Australia’s ASX 200 (ASX) index stock market benchmark opened mildly higher on Thursday before letting go early gains. Concerns remain on the Covid-19 situation, especially in the Victoria area, after reporting a record 15 coronavirus deaths on Wednesday. The second-largest city of Australia has seen hundreds of new cases recorded daily in recent weeks, including 725 on Wednesday. Risk sentiment is likely to remain subdued in the days to come, inhibiting the ASX 200 index from reaching higher levels.

Technically, the ASX 200 index faces a strong resistance level at 6,100 – the 61.8% Fibonacci retracement (chart below). As the index recovered from March’s lows, it has formed an ‘Ascending Triangle’ on its daily chart. The upper bound of the triangle coincides with the 61.8% Fibonacci retracement, reaffirming this critical resistance. The 20-Day, 50-Day and 100-Day Simple Moving Averages (SMAs) suggest the overall trend remains bullish.

ASX 200 Index – Daily Chart

Straits Times Index Outlook:

Singapore’s Straits Times Index stock benchmark bounced for a third straight day after hitting a key support level at 2,500. The release of 2Q bank earnings from DBS and UOB helped to boost market sentiment.

DBS saw a 26% plunge in 1H net profit as it set aside a general allowance of SGD 1.26 billion to weather the Covid-19 impact. Profits before allowances were up 12% to a new high of SGD 4.71 billion. The highlight is that the bank managed to deliver a 1% YoY increase in net interest income despite a 16bps fall in the net interest margin (NIM), as both loans and deposits grew. Fee income and other non-interest income increased by 1% and 42% respectively from a year ago. These are indeed very impressive and potentially encouraging results.

Straits Times Index – Daily Chart