ISM Services PMI, US Dollar, COVID-19 – Talking Points:

- ISM non-manufacturing rises to 57.1, beating estimates

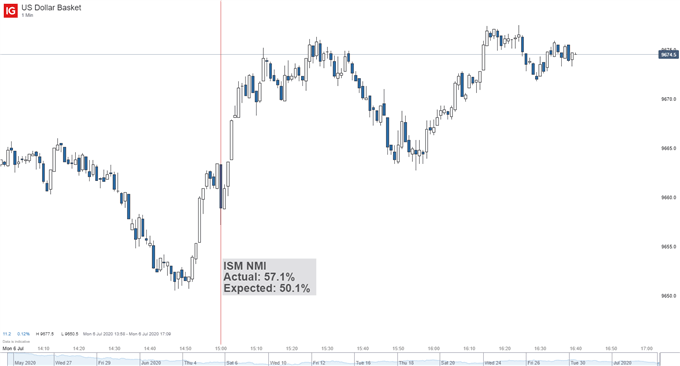

- US Dollar weakness abates following report’s release

- Risk-on mood carries equity markets higher Monday morning

The Institute for Supply Management’s Non-Manufacturing Index rose to 57.1 for June, beating expectations of 50.1 and the best read since March. US Dollar price action ticked modestly higher as the report crossed the wires, but the overall risk-on sentiment pushing equities higher Monday morning continues to dominate market direction , as Asian markets started the week with an upbeat tone.

US Dollar Basket (1-Min Chart)

Source: IG Charts

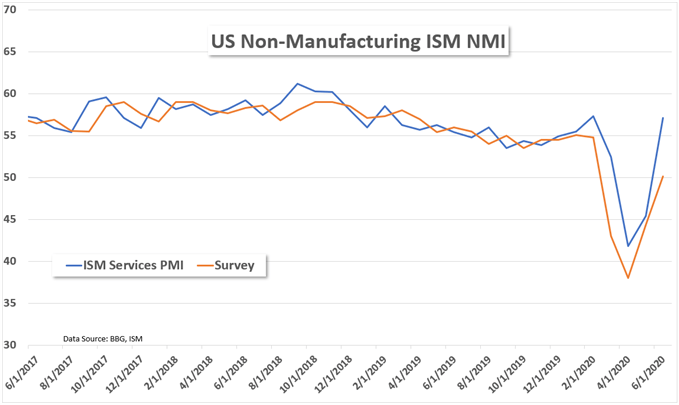

In line with risk appetite seen across Asian markets, US equities are trending higher in Monday’s morning trading session, with the S&P 500 index up over 1.50% currently. This morning’s NMI figures show that the US economy has returned to a phase of expansion following the sharp drop into negative territory seen in April, as the COVID-19 pandemic shuttered economic activity.

Business activity witnessed a healthy gain for June, rising from 41 to 66. The sharp rise in this component of the index is likely attributable to the reopening of businesses following the economic lockdowns through April and May. In conformity with growing business activity, new orders also saw a healthy increase for June. One survey respondent in the report is noted saying “Sales have picked up tremendously. Sporadic supply issues. Biggest concern for us is lumber shortage.”

ISM Non-Manufacturing NMI

Even though the ISM report is positive regarding an economic comeback, signs of trouble still linger, particularly concerning the labor market. While employment activity rose from the prior month in June according to the ISM report, June marked the fourth month of contraction. This follows last week’s mixed jobs data from the non-farm payrolls report and initial jobless claims. Markets now look ahead to Thursday's initial jobless claims data to gauge the strength of the labor market, a key theme in the economic recovery story.