Market sentiment analysis:

- Trader confidence has improved so far this week as hopes of continued monetary stimulus outweigh concerns about a second wave of coronavirus infections.

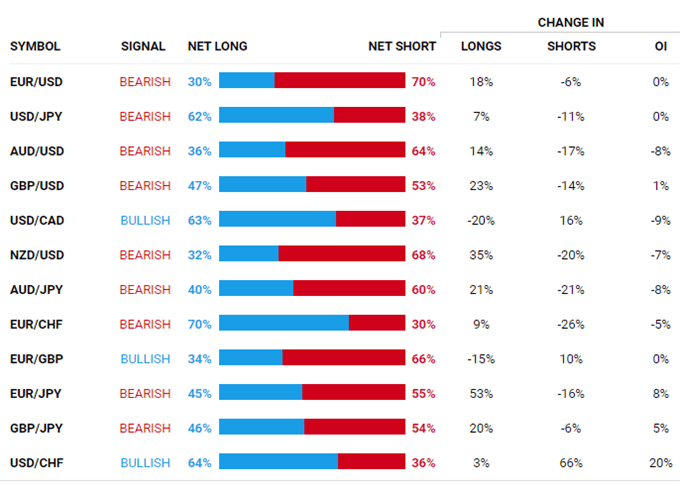

- However, IG Client Sentiment data on the positioning of retail traders is sending out bullish signals for the safe haven currencies: the US Dollar, the Japanese Yen and the Swiss Franc.

Trader confidence to ebb away?

Traders have moved back in to riskier assets so far this week as hopes of yet more monetary stimulus outweigh fears about a second wave of coronavirus infections. However, IG client sentiment data – based on the positioning or retail clients using the IG trading platform – are sending out bearish signals for the “risk on” currencies like AUD, GBP and EUR, and bullish signals for safe havens such as the US Dollar, the Japanese Yen and the Swiss Franc.

In this webinar, I looked at the trends in the major currency, commodity and stock markets, at the forward-looking data on the economic calendar this week, at the IG Client Sentiment page on the DailyFX website, and at the IG Client Sentiment reports that accompany it. You might also like to check out the DailyFX Trading Global Markets Decoded podcasts.

Like to know more about the psychology of trading? Our guide is here

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below