Canadian Dollar (USD/CAD) Price Outlook:

- USD/CAD suffered a bearish break beneath horizontal support last week which allowed further losses

- Trading lower still, USD/CAD may look to fill the gap that exists slightly beneath the current price

- Learn the different trading styles to see what type of price action best suits you

Canadian Dollar Forecast: USD/CAD Extends Losses as Dollar Weakens

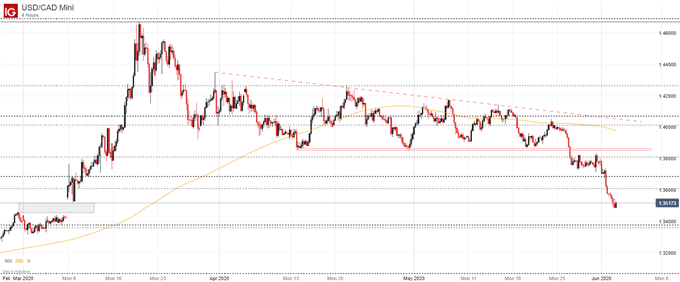

The US Dollar has extended its decline at the start of June, compounding losses suffered in the last few weeks. In turn, the Canadian Dollar has found itself in an advantageous position which has sent USD/CAD plummeting beneath support as it threatens further losses. Without a clear cut area of buoyancy nearby, the pair may fall quickly as it looks to fill the gap that exists slightly beneath the 1.3520 level.

USD/CAD Price Chart: 4 – Hour Time Frame (March 2020 – June 2020)

As I warned last week, the bearish break beneath support around 1.3853 was a significant development for USD/CAD as the technical level had helped keep price afloat since mid-April. With it in the rearview, bears were able to quickly drive price lower, discarding other possible areas of support in the process. Consequently, USD/CAD is approaching a lower gap that exists from 1.3517 to 1.3456.

Trading the Gap: What are Gaps & How to Trade Them?

Devoid of technical barriers nearby, the open space may allow the Canadian Dollar to climb further against the Greenback, which may see USD/CAD eventually grasp for support in the 1.3368 zone where two Fibonacci levels reside. Until then, it would seem the pair is highly vulnerable to further losses and the broader trend remains downward.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

Furthermore, IG Client Sentiment data reveals retail clients remain net-long the pair, even as it continues to decline. With our typical contrarian bias regarding client sentiment, we can surmise that USD/CAD is exhibiting signs of weakness in this regard as well. As price action develops, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX