GBP/USD and Bank of England Analysis and Talking Points

- Mortgage and Credit Card Lending Expected to Drop

- BRC Retail Sales Post Record Fall

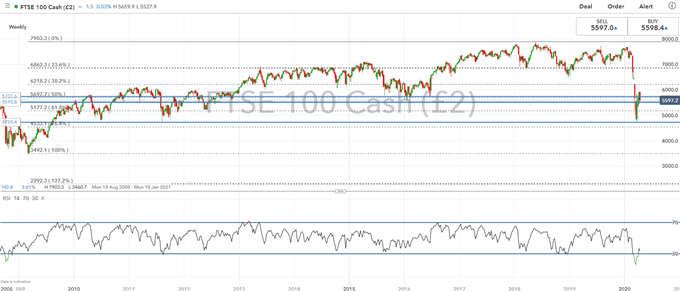

- FTSE 100 Muted, Support Eyed

Bank of England Credit and Liabilities Survey

According to the Bank of England’s credit conditions survey, UK lenders expect demand for mortgages to see its largest drop in several years, while credit card lending is expected to fall to levels seen at the backend of 2019. The survey noted that mortgage and corporate lending default losses are expected to rise. Subsequently, this highlights expected hit that the coronavirus led slowdown is expected to have on the UK economy.

Record Plummet in Retail Sales

Alongside this, the BRC reported that retail sales in the UK had fallen by its fastest pace on record in March having plunged 4.3% (Prev. 0.1%) amid the governments lockdown measures.

Market Reaction: little reaction seen in GBPUSD or the FTSE 100 to the Bank of England’s credit survey. That said, the latter is extending on yesterday’s heavy losses with the index dipping 0.2%, near term support situated at 5510, while on the topside, 5700 will be the first key test.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Looking Ahead: BoE’s Tenreyro is scheduled to speak at 1430BST on monetary policy, with particular attention being placed on inflation. That said, while Tenreyro’s commentary is unlikely to spark a notable reaction in UK assets given the current macro backdrop. It will be noteworthy for any hints as to what would spark further easing measures.

FTSE 100 Price Chart: Weekly Time Frame

Source: IG Charts

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX