USD/CAD Price Forecast:

- Coronavirus fears helped spark drastic stock market declines and a flight to safety, USD/CAD climbed

- The move reversed last week’s journey lower and may allow the pair to take another run at resistance

- IG Client Sentiment Data reveals retail traders remain overwhelmingly short USD/CAD, a potential sign of further bullishness

USD/CAD Bounces on Risk Aversion

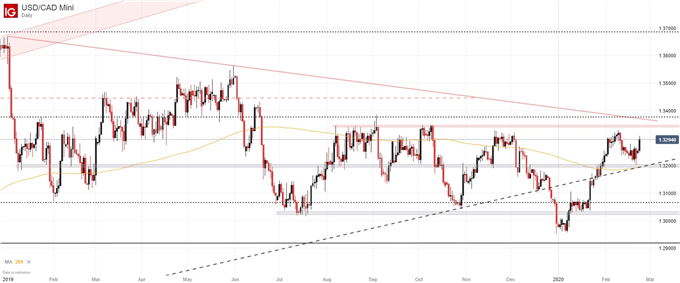

USD/CAD rallied to start the week, continuing its move off confluent support around the 1.32 level. While the technical moat may have provided assistance in staving off deeper declines last week, volatility elsewhere suggests much of Monday’s move may be attributable to coronavirus concerns.

To that end, confirmed cases in the United States and Canada are relatively low, but the price of crude oil – a key export of Canada – has been battered which may have played a role in the Canadian Dollar’s decline. A broader flight to safety, via the US Dollar, is another likely culprit.

USD/CAD Price Chart: Daily Time Frame (January 2019 – February 2020)

Either way, IG Client Sentiment Data reveals traders are overwhelmingly net-short which may suggest further gains are in store. Should bullish price action continue, USD/CAD may look to target longstanding resistance overhead, which currently resides around the 1.3345 level.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

If the driving forces behind USD/CAD change and bears attempt another move lower, the pair will still enjoy a bounty of support around the 1.32 level. If volatility cools and calmer price action prevails, the pair could look to bounce between the two longstanding levels of support and resistance as it works sideways in a larger range. In the meantime, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX