Crude Oil Price Outlook:

- Crude oil fell precipitously in January as coronavirus fears eroded risk appetite and growth prospects for the Chinese economy alike

- After its decline from $65.40 to nearly $51, crude oil finds itself on the precipice of a technical bear market

- OPEC is in the middle of a multi-day meeting in which production cuts have been discussed, a potential lifeline for crude prices

Crude Oil Price Forecast

Crude oil narrowly escaped bear market territory (defined as a decline of 20% or more from a recent high) on Wednesday as it climbed from Tuesday’s lows around $49.50 to reclaim the $51 mark. While crude has escaped the technical designation of a bear market for the time being, the commodity’s outlook remains in question.

The spread of coronavirus has resulted in quarantined cities and reduced economic activity in China, a key source of crude oil demand. In turn, crude oil prices plummeted and have been buoyed by technical support around $50 and the potential for deeper production cuts. To that end, OPEC officials engaged in a series of meetings this week to discuss possible options for the members to pursue. If the group can agree to further reduce production, it could result in a boost in crude oil prices, but Russia has already voiced opposition.

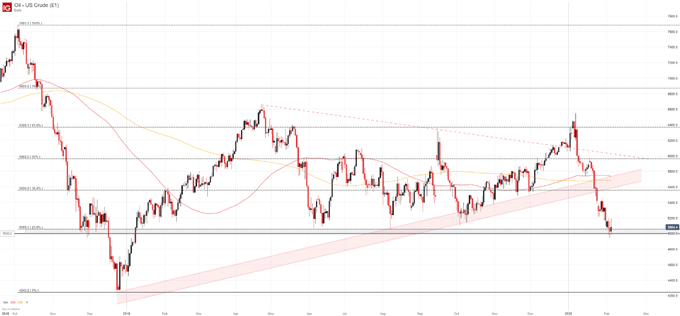

Crude Oil Price Chart: Daily Time Frame (October 2018 – February 2020)

That being said, the prospect of deeper production cuts providing a lifeline for crude oil prices looks thin at the time being. Therefore, the growth-linked commodity may struggle to reclaim lost ground until virus fears cool and growth forecasts level off. If a rebound does occur, initial resistance may reside around $53.90, followed by the Fibonacci level at $55.57.

On the other hand, a break beneath – and daily close below – the psychologically significant $50 could translate to further crude oil weakness. Should it occur, subsequent support is rather sparse which could see losses accelerate toward the December 2018 low around $42.43. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX