Dow Jones, Nasdaq 100 & S&P 500 Forecasts:

- The Dow Jones is slightly beneath record levels, but with US-Iran tensions on the rise and a potential shift in the Fed’s policy, it may seek technical support

- Similarly, the Nasdaq 100 and S&P 500 enjoy a series of supportive levels beneath should bearish price action emerge

- Will the Stock Market Crash in 2020?

Dow Jones, Nasdaq 100, S&P 500 Forecasts: Watch Out Below

After rounding out 2019 with a return of nearly 25%, the Dow Jones has paused near record levels as US-Iran tensions flare and the Fed’s balance sheet expansion comes into question. With an increasingly uncertain fundamental backdrop and the index’s recent inability to push higher, it could be argued the stage has been set for a modest retracement in equity prices.

With that in mind, it is important to make note of the various technical support that may be present underneath.

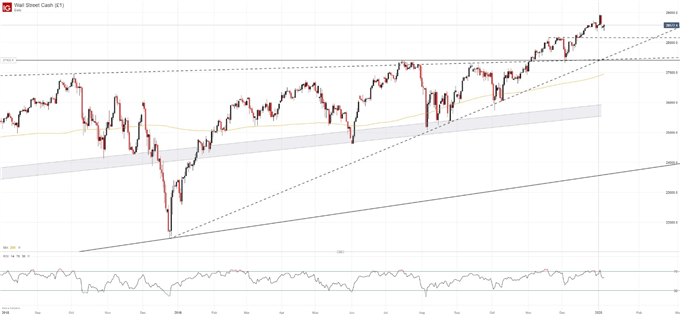

Dow Jones Price Chart: Daily Time Frame (August 2018 – January 2020) (Chart 1)

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

Turning to the Dow Jones specifically, initial support may come into play around the 28,158 level which offered moderate resistance in November and December. Beneath the horizontal zone, an ascending trendline from December 2018 may serve as a “line in the sand” standing between the Industrial Average and a deeper retracement. Similarly, 27,345 may mark another important level for the index if bearishness really picks up.

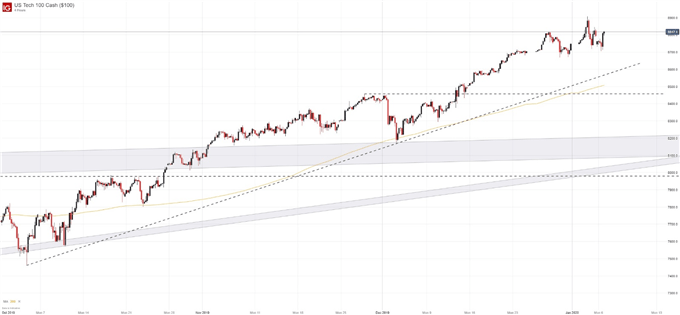

Nasdaq 100 Price Chart: 4 – Hour Time Frame (October 2019 – January 2020) (Chart 2)

Difference between Dow, Nasdaq, and S&P 500: Major Facts & Opportunities

Still, there is nothing to suggest a move of such magnitude will occur sometime soon, only that the fundamental landscape has deteriorated and that the Fed may soon remove a key tailwind. In the case of the Nasdaq 100, an ascending trendline from October will look to keep the index afloat around 8,660 before subsequent assistance materializes around 8,450.

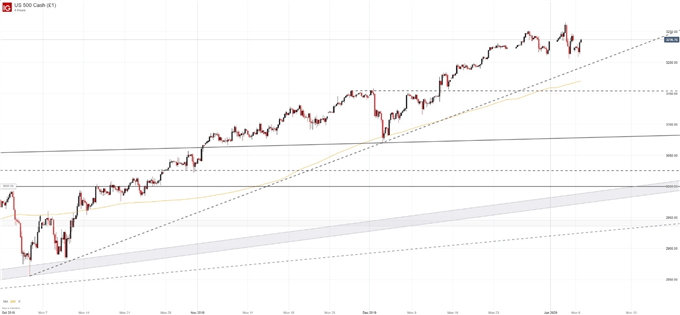

S&P 500 Price Chart: Daily Time Frame (December 2018 – January 2020) (Chart 3)

The technical pattern for the S&P 500 is very similar to that of the Nasdaq 100, as both look to employ a line of horizontal support before turning to an ascending trendline from October. For the Nasdaq, 3,200 may offer a modicum of influence before the horizontal level at 3,150 is required. In the periphery is the ascending trendline that may look to buoy the S&P 500 in the medium term.

While the fundamentals have eroded, the path of least resistance is higher still. Therefore, price may continue to melt up or float sideways until the market is offered a material development on the Fed’s balance sheet or there is a serious escalation between the United States and Iran. In the meantime, follow @PeterHanksFX on Twitter for updates on the various US equity indices.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Australian Dollar Forecast: AUD/USD Surges, but Rally Looks Overdone