Australian Dollar Forecast:

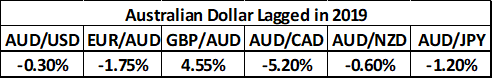

- The Australian Dollar was a laggard in 2019 as slowing global growth and the US-China trade war pressured the pro-risk currency

- Now, a recent turnaround in risk appetite has sent AUD/USD soaring off October’s lows

- Will the trade deal signing send the Australian Dollar higher still, or is it a case of “buy the rumor, sell the news?”

Australian Dollar Forecast: AUD/USD Surges, but Rally Looks Overdone

The Australian Dollar suffered against most major currencies in 2019 as the US-China trade war weighed on the Aussie’s performance. Recently, however, the announcement of a “Phase One” trade deal revived the currency’s outlook and AUD/USD has been a major benefactor – surging from October’s lows and piercing various levels of technical resistance.

AUD Performance in 2019. Source: TradingView

After President Trump announced the United States and China will meet to sign the deal on January 15, the Australian Dollar enjoyed another bump, moving comfortably beyond prior resistance. With risk sentiment shifting and the Aussie Dollar reaping the rewards, can the Australian Dollar continue higher or has the reaction become overblown?

AUD/USD Forecast

Looking to AUD/USD specifically, recent fundamental developments have seen the pair clear various levels of technical resistance. Moving forward, past resistance will look to serve as future support and keep AUD/USD afloat should risk aversion reemerge. To that end, current conditions reveal the rebound has likely become overextended as RSI treads in overbought territory.

AUD/USD Price Chart: Daily Time Frame (December 2018 – January 2020) (Chart 1)

With the Aussie Dollar’s spike on the initial trade deal announcement and subsequent follow-through on December 31, it could be argued much of the trade deal’s impact has been baked into the currency’s price already. Since the specifics of the deal are astoundingly scant and history suggests the eventual deal will likely disappoint, AUD/USD may be offered a catalyst for consolidation and see price threaten prior resistance.

With that in mind, AUD/USD may be ripe for bearish opportunities as traders look to sell the news as the January 15 signing-date nears. Therefore, a key area of invalidation exists around the 0.7080 level which coincides with the pair’s swing-high in July. Should AUD/USD surpass this level, it would suggest risk appetite remains robust and the currency is still adjusting to the news of the trade deal.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

That being said, areas of interest on the short-side reside around the 0.6910 level which aligns with the pair’s swing-low in July, a zone which created indecision in the past. A move to this price would provide sufficient consolidation for a subsequent rebound higher in my opinion, as the longer-term impact of the trade deal is felt, and global growth forecasts are revised higher.

Still, the shorter-term conditions of AUD/USD may see Aussie bearishness prevail as expectations are adjusted in the intermediate timeframe. In the meantime, follow @PeterHanksFX on Twitter for updates on this trade idea.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: How to Invest During a Recession: Investments & Strategy