Dow Jones, Nasdaq 100, S&P 500 Forecasts:

- The Fed expectedly cut interest rates by 25 basis points

- Fed Chairman Powell’s corresponding press conference revealed a relatively clear policy path

- Consequently, the Dow Jones, S&P 500 and Nasdaq 100 could look to drive higher with an accommodative central bank behind them

Dow Jones, Nasdaq 100, S&P 500 Forecasts Following the Fed's Rate Cut

Stock market participants may have been offered a new reason to be bullish after Wednesday’s Federal Open Market Committee meeting. At the meeting, it was revealed the central bank issued yet another 25-basis point cut, as markets expected. While the materially dovish development should help to buoy equities, it had little impact on the various stock indices – suggesting the rate reduction was already fully priced in. On the other hand, an effectively hawkish decision to remove language of further accommodation initially sparked bearishness, but Chairman Powell’s commitment to sustaining the current expansion outweighed the apparent conclusion of the mid-cycle adjustment.

S&P 500 Price Chart: 1 – Minute Time Frame (October 30) (Chart 1)

To that end, Chairman Powell revealed rate hikes in the near term are highly unlikely. On the matter, Mr. Powell argued the case for rate hikes would require a serious uptick in inflation – a metric that is currently running significantly under target. Consequently, the decision to pause rate cuts accompanied by the assurance that rate hikes are not on the table - unless inflation rises notably - essentially signals the bank’s next move is more likely to be lower than higher and the market’s bullish reaction would suggest a majority of traders arrived at a similar conclusion.

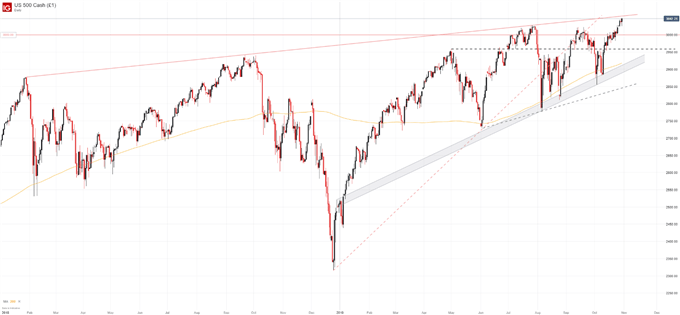

S&P 500 Price Chart: Daily Time Frame (January 2018 – October 2019) (Chart 2)

With that in mind, the Fed’s policy is arguably clearer than what it has been in recent months. Unless inflation rises significantly, there is no reason to hike rates and if data continues to disappoint, the Fed may act as appropriate and lower rates even further. In turn, Chairman Powell’s position could have just laid the groundwork for another leg higher for the Dow Jones, Nasdaq 100 and S&P 500 as the central bank stands to protect economic expansion. With the three markets trading near all-time highs, check out a technical outlook for the indices and follow @PeterHanksFX on Twitter for further updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Amazon Earnings and Consumer Appetite, Will Trade Wars Steal Christmas?