CAD Analysis and Talking Points

- BoC maintains interest rates as expected at 1.75%

- Cautious monetary policy statement given trade war risks.

See our latest Q3 FX forecast to learn what will drive the currency through the quarter.

CAD Drops as Bank of Canada Flags Concerns of Trade Wars

Growth: The Bank of Canada kept interest rates unchanged at 1.75% as expected. In light of recent encouraging data, the BoC had upgraded their Q2 GDP forecast to 1.3% from 1% citing an unwind of the temporary factors that had plagued GDP growth in the beginning of the year. Consequently, the central bank forecasts 2019 growth at 1.3%, up from April’s forecast of 1.2%, however, this remains below the 1.7% expected in January. The BoC continue to highlight that global trade conflicts remain the largest risks to the global and domestic outlook, thus this caution has pushed the Canadian Dollar lower.

Inflation: Despite both headline and core inflation hovering around the middle of the BoC’s target range of 1-3%. The BoC expect inflation to drop 0.1ppt in both 2019 and 2020 to 1.9% and 2% respectively with near term impacts being due to dynamics in gasoline prices.

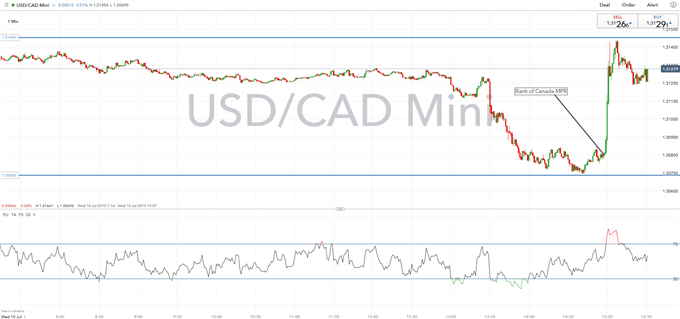

Market Response: In reaction to the more cautious BoC statement, the CAD drop against the USD with USDCAD back above the 1.3100 handle to test the top of its recent range at 1.3140. Overall, the statement emphasises that the BoC will remain on the side-lines with the outlook largely determined by the outcome of the US-China trade wars. As such, the BoC are likely to stand pat throughout the remainder of the year, while the bar to raise interest rates has increased slightly.

USDCAD Price Chart: 1-minute time frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX