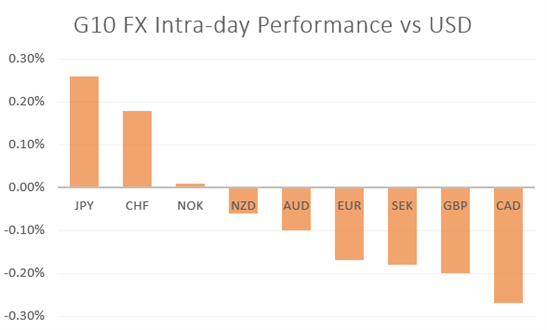

MARKET DEVELOPMENT – JPY and CHF Advance, Crude Oil Prices Extend Losses

DailyFX Q2 2019 FX Trading Forecasts

JPY / CHF: Risk aversion is evident across financial markets with both the Japanese Yen and Swiss Franc outperforming as a result. USDJPY tests 110.00 on the downside with the drop in US Treasury yields also weighing on the pair, eyes on for a test of the weekly low at 109.80.

EUR: The Euro is slightly softer this morning as Eurozone PMIs on the whole had disappointed market expectations with optimism over a rebound in the Eurozone slowly dissipating. Elsewhere, the latest ECB minutes remains dovish with rate setters highlighting concerns over uncomfortably low inflation and also signalling their lack of confidence that the Eurozone economy will rebound as they had expected in H2 19.

GBP: As pressure ramps up for Theresa May to hand in her resignation, volatility in the Pound is back on the rise with option implied vols edging higher (still some way from the March highs), while demand is starting to pick up for GBP puts as markets begin to price in the rising risk of a no-deal.

Oil: Losses in the energy complex have continued with Brent and WTI crude breaking below $70 and $60 respectively. After yesterday’s bearish DoE report which showed a surprise build of 4.7mln barrels (also above the 2.4mln build in API) oil prices took a further knock on the softer sentiment in equity markets. Consequently, the drop-in oil prices have weighed on the Canadian Dollar, which underperforms in the G10 space.

Source: DailyFX, Thomson Reuters

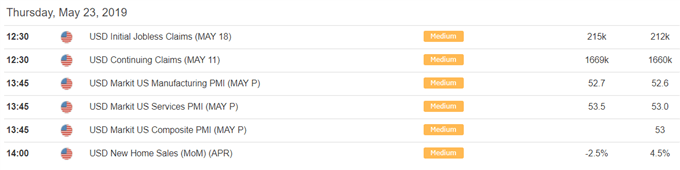

DailyFX Economic Calendar: – North American Releases

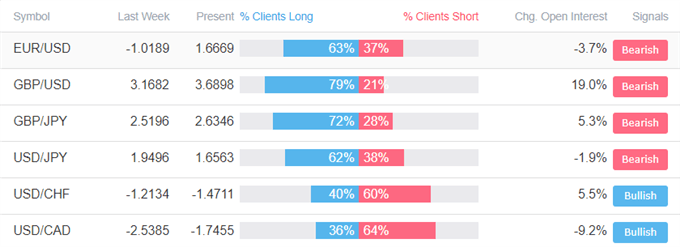

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Crude Oil Price Outlook Weakens, Stock Markets Sink on Trade Fears” by Nick Cawley, Market Analyst

- “Gold Prices Maintain Downtrend, However, Pivotal Support Holds” by Justin McQueen, Market Analyst

- “Eurozone PMIs and Ifo Index Miss Expectations, Euro Shrugs” by Martin Essex, MSTA, Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX