US Dollar and Consumer Sentiment - Talking Points

- The May UofM Consumer Sentiment reading report a 15-year high for the index at 102.4

- Year-over-year change for the index has supported enthusiasm at 4.5% growth

- US Dollar marches higher on increased inflation expectations, lowering expectations of a rate cut

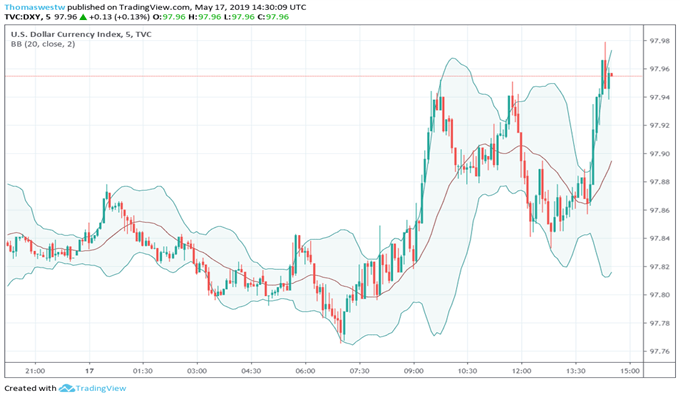

The University of Michigan Consumer Sentiment Index’s May update printed a reading of 102.4 this morning, putting the index at a 15-year high, as consumers grew more upbeat about the US economy. The report lifted the US Dollar to intraday highs with the DXY rising from 97.88 to 97.95 and still climbing at the time of writing.

The Greenback’s rise may also be attributable to a boost in inflation expectations with the report putting 1-year inflation expectations at 2.8%, an increase from the 2.5% the month before. Higher expectations of inflation could be bolstering the currency by reducing the odds that the Federal Reserve will be cutting rates in the future. As it stands, Fed Funds futures are still pricing in an approximate 73 percent probability of a 25 basis point rate cut by the end of the year.

DXY US DOLLAR INDEX PRICE CHART: 5-MINUTE TIME FRAME (MAY 17, 2019 INTRADAY)

Although the Consumer Sentiment Index soared to a 15-year high, the survey’s economists noted the data was gathered before the breakdown in trade talks between the US and China manifested. Consumer’s expectations were likely boosted by prospects of a trade deal closing soon and the S&P 500 trading near all-time highs. In fact, the University of Michigan’s survey component of consumer expectations jumped from 87.4 to 96.0 which highlights how much weight consumers are putting on trade war rhetoric. In contrast, the current conditions component of the survey was little moved with a tick higher from 112.3 to 112.4.