TALKING POINTS – SELIC RATE, USD/BRL, PENSION REFORM

- USD/BRL, Ibovespa eyeing Selic rate decision

- Economists are expecting hold at 6.50 percent

- What is driving Brazilian monetary policy?

See our free guide to learn how to use economic news in your trading strategy !

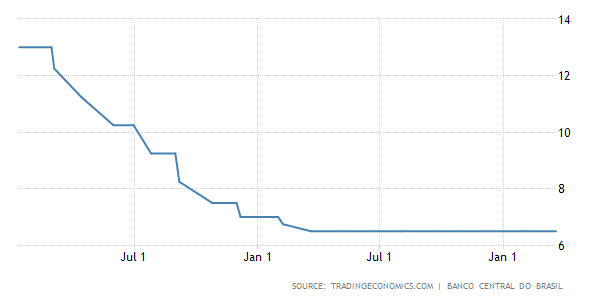

Tomorrow, Banco Central do Brazil will be announcing its decision on whether it will adjust the benchmark Selic rate. The decision by the nine-committee council – known as Copom – will be released on May 8 at 21:00 GMT. Since April 2018, the central bank has held rates at 6.50 percent following a series of deep cuts in 2017 that were used as a way to stimulate growth after the country endured a recession.

Analysts are expecting for officials to keep interest rates at this all-time low until there are clear signs that President Jair Bolsonaro’s pension reforms are able to survive in the legislature. Later today, the president of the lower house’s special commission will announce a schedule for the debates. This follows last month’s landmark decision to declare that the pension reforms were constitutionally legal.

Similar to how the BoE is guiding its policy around the outcome of Brexit, the Brazilian central bank is holding on any rate adjustments until there is further clarity on pensions policy. To read more about why progress on these reforms is driving Brazilian financial markets and influencing local monetary policy, read my updated BRL and Ibovespa outlook here.

However, the Brazilian central bank finds itself at a cross roads. Economic indicators have been broadly underperforming relative to economists’ expectations, with last week’s industrial production data missing estimates. That might imply broader implications for global growth, preceding the recent deterioration in US-China trade relations.

The probability of another Brazilian recession will likely rise if the pension reforms are not passed this year, making the market impact of each development that much greater. Volatility is likely to be amplified as the clocks runs out. You may follow me on Twitter @Zabelin.Dimitri for updates on the pension reforms and the reaction in local assets.

Selic Rate Decisions 2017-2019

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter