Australian Dollar, Reserve Bank of Australia Monetary Policy Decision, Talking Points:

- The RBA left official Australian base rates on hold at 1.25%

- Markets had looked for a possible cut this month

- The RBA seems to have linked action more directly to the jobs market

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

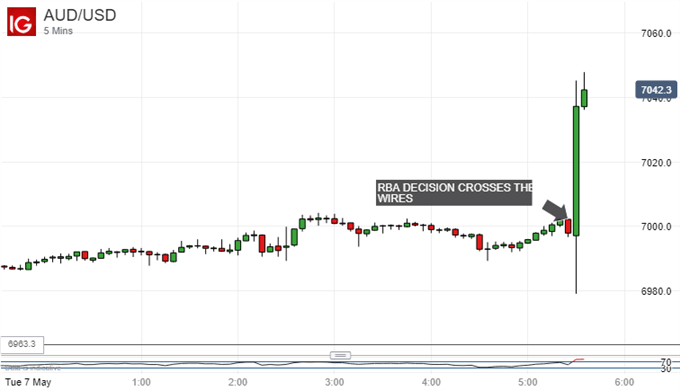

The Australian Dollar leapedas the Reserve Bank of Australia kept its key Official Cash Rate at its record low of 1.50%, thwarting expectations of a further cut.

Rate-futures markets had been quite aggressively pricing in a reduction thanks to enduringly feeble inflation data. The RBA acknowledged this but also strength in the labor market which, it feels, may yet take up the remaining economic slack and boost pricing power.

Given that markets had put the chance of a cut this month at close to 50% it’s hardly surprising that AUD/USD should have gained as it did.

Rate futures markets are still pricing it at least one quarter point reduction in the OCR over the next eighteen months and possibly two. However the RBA’s strong focus on the labor market will probably leave pricing hostage to developments there in the near term,

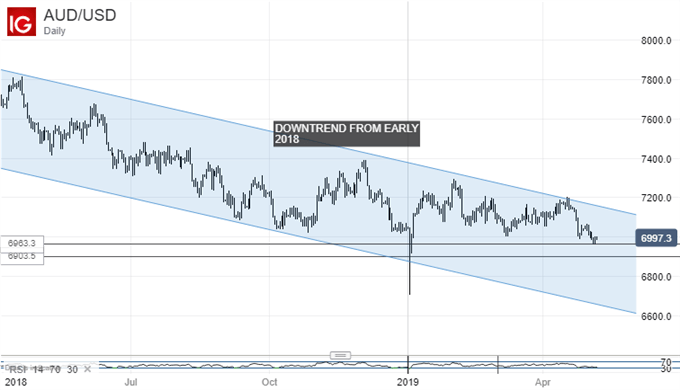

On its daily chart AUD/USD remains well within the long downtrend channel which has bounded trade since the pair topped out early last year. Pressure on the Aussie ameliorated somewhat in the early part of this year as the markets moved to price in a more cautious pace of interest rate rises in the US.

Pressure has resumed however as markets come to realize that the Australian Dollar lacks domestic interest rate support of its own. So far, the pair has slid back to the lows which marked the transition into 2019, but there has been little appetite to test the ground below them.

The RBA’s latest decision may keep that ground out of reach for the time being, as investors await monthly labor market releases from Australia.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!