TALKING POINTS – TRADE WAR, US-CHINA TRADE RELATIONS, GLOBAL GROWTH

- Risky assets suffer from Trump tariff threat tweets

- JPY, USD, CHF rise amid demand for anti-risk assets

- How will global financial markets respond to the news?

See our free guide to learn how to use economic news in your trading strategy !

APAC markets had a sour taste in their mouth early into Monday’s trading session. US President Donald Trump tweeted that on Friday, Washington will increase tariffs on $200 billion in Chinese imports from 10 to p25 percent. He also threatened to extend the 25% tariff to a further $325 billion worth of goods from the world’s second-largest economy.

This could lead Beijing to ramp up their own economic arsenal and prepare for retaliation. In his tweet, Trump expressed dissatisfaction with the current state of negotiations, hinting that hawks within administration are growing impatient with the slow pace of progress. The disruption comes amid comments that talks were going “well”, with expectations that a deal was to be reached by the end of the month.

It also creates an awkward backdrop for US-China trade negotiations in light of Vice Premier Liu He’s visit to Washington on Wednesday to conclude what was to be expected to be the final round of trade talks.

This comes as major equity indices have reached new highs or at the very least have come close to their previous 2018 records. A collapse in trade negotiations – a fundamental theme that has dragged markets through the mud – could spark significant market volatility. Global PMI’s and other major leading indicators have shown that the outlook for global growth is much weaker than previously expected, with the IMF and WTO citing ongoing trade wars as a major cause for deceleration.

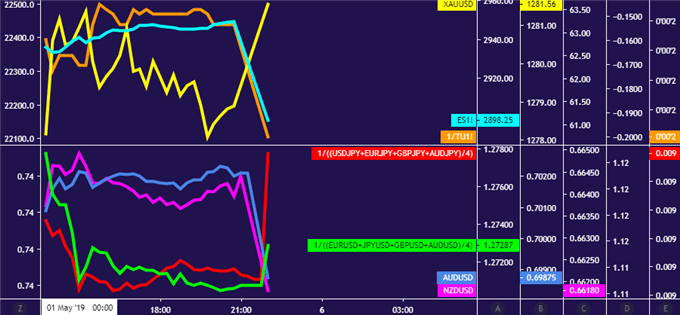

While risky assets have suffered amid this news, anti-risk alternatives like the Japanese Yen, US Dollar and Swiss Franc have risen. If relations continue to deteriorate, we may see a magnification of these assets’ reactions, especially if prevailing global economic conditions do not look healthy.

DOLLAR INDEX, AUD/USD, NZD/USD, GOLD, S&P500 FUTURES, YEN INDEX

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter