AUD/USD, China CPI Talking Points

- AUD/USD eyeing China loan, trade balance after CPI rose

- Those may surprise higher, boosting the Australian Dollar

- AUD/USD upside breakout faces resistance under 0.7207

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

The Australian Dollar remains above key resistance as it awaits a slew of potentially market-moving Chinese economic data. In the meantime, headline CPI in the world’s second-largest economy picked up to 2.3% y/y in March from 1.5% in February as expected. Meanwhile, wholesale inflation clocked in at 0.4% y/y from 0.1% prior as anticipated.

The pickup in Chinese prices follows a similar uptick in manufacturing PMI data which in the same period, rose to 50.5 and indicated expansion for the first time since October. While not surpassing estimates, Chinese CPI data did not disappoint either. As of late, local economic data has been tending to outperform relative to economists’ expectations, offering a cooldown in growth concerns.

If decent economic readings continue crossing the wires, AUD/USD may find support given Australia’s critical trading relationship with China. To that end, at an unspecified time these next few days, we will get Chinese new Yuan loans and trade data. Until then, the Aussie may benefit from ebbing RBA rate cut bets if they are overpriced. Keep an eye on commentary from RBA’s Deputy Governor Guy Debelle who may uphold this.

AUD/USD Technical Analysis

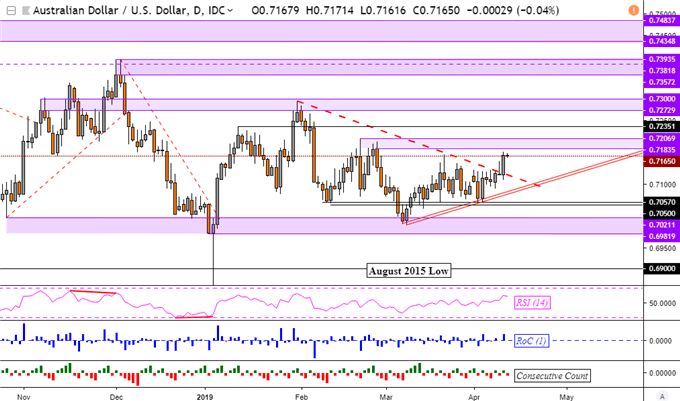

On the daily chart below, the Australian Dollar has made a critical push above the US Dollar as AUD/USD cleared a descending resistance line from February. As noted in this week’s technical forecast, a breakout in the Aussie should require confirmation. For that, watch how resistance behaves between 0.7184 and 0.7207 next. You can follow me on Twitter for the latest updates in AUD here at @ddubrovskyFX.

AUD/USD Daily Chart

Chart Created in TradingView

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Aussie is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter