Asia Pacific Market Open Talking Points

- USD/JPY tumbles as S&P 500 leaves behind reversal warning

- EU-US trade war fears, IMF 2019 outlook and Italy sink DAX

- Nikkei 225 may fall with AUD as Japanese Yen extends rally

Find out what the #1 mistake that traders make is and how you can fix it!

FX News Tuesday

The anti-risk Japanese Yen was the best-performing major on Tuesday, rising alongside a downturn in market sentiment as anticipated. This was triggered by a trio of concerning developments. First, the United States escalated trade tensions with the European Union, threatening to impose $11b in tariffs on their imports because of EU subsidies for Airbus, a major commercial aircraft maker.

Then later in the day, Italy trimmed 2019 GDP estimates to 0.1% from 1.0% as it raised this year’s budget deficit forecast to 2.5%. The latter has been a sticking issue between the country and with Brussels, increasing concerns about a Eurozone debt crisis. Lastly, the IMF cut the 2019 global outlook to its weakest since the 2008 financial crisis.

After the German DAX 30 tumbled by the most in over two weeks (as expected), the S&P 500 followed suit as it ended its longest winning streak (8 days) since early October. US front-end government bond prices rallied, signaling risk aversion that engulfed the markets. The haven-linked US Dollar was little changed though, mainly due to losses during the first half of the trading session.

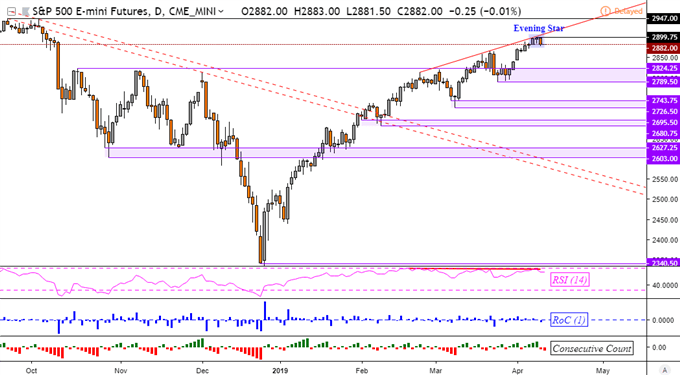

S&P 500 Technical Analysis

Taking a look at the more liquid futures, the S&P 500 left behind a bearish reversal warning at its latest peak just under 2900. That would be an Evening Star that is coupled with negative RSI divergence, signaling fading upside momentum. This may precede a turn lower towards a range of support between 2789 and 2824 on the daily chart below.

S&P 500 Daily Chart

Chart Created in TradingView

Wednesday’s Asia Pacific Trading Session

The downturn on Wall Street poses as a risk for Asia Pacific equities, particularly with rising concerns about another trade war front and slowing global growth. It wouldn’t be too surprising to see the Japanese Yen extend its advance while the pro-risk Australian Dollar takes a hit. The latter will also be looking to local consumer confidence which may surprise higher, extending AUD/NZD’s bullish reversal.

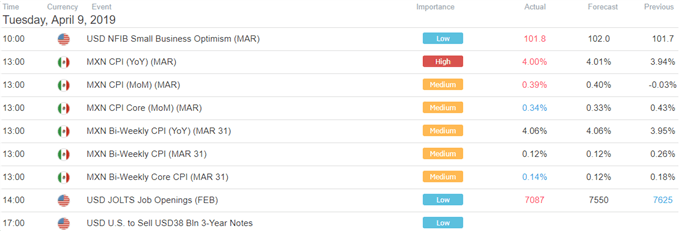

US Trading Session Economic Events

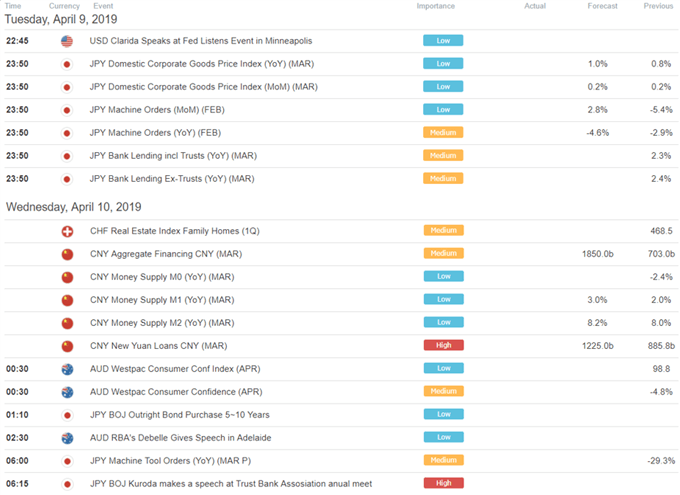

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter