GBP Price, News and Latest Analysis

- EU Emergency Summit may see Brexit divorce pushed out to next year.

- ECB rate decision and press conference.

- Latest FOMC Minutes released.

Q2 2019 GBP Forecast and USD Top Trading Opportunities

ECB Rate Decision, EU Emergency Brexit Summit and FOMC Minutes:

A slow start to the week but market volatility will pick-up mid-week with a cluster of potentially market moving events scheduled for Wednesday. The latest ECB monetary policy decision will be released, followed by President Mario Draghi’s press conference with market participants listening for any further clues on the underlying weakness of the Euro-Zone economy. All monetary policy settings are fully expected to be left unchanged but further information about recent bank tiering discussions may be released along with the outlook for growth and inflation in the single-block.

Euro Outlook Bearish, EURUSD May Fall on ECB. Brexit Deadline Nears.

In the US, the latest FOMC Minutes are expected to show that the Fed remained concerned over the health of the economy and that further US interest rate hikes are now highly unlikely. An accommodative Fed will likely see risk assets remain bid while the US dollar may drift lower along with US Treasury yields.

US Dollar Weekly Forecast: ECB Meeting, US Inflation, FOMC on Tap.

An emergency EU Summit is expected to see the UK offered an extension to the current Brexit date (April 12) after EU Council President Donald Tusk openly suggested a 9-12-month extension to the process to help the UK find a workable consensus. This may kick the can down the road, but as with all things Brexit, a lot can happen before this meeting.

Sterling (GBP) Fundamental Outlook: Leaning Towards a Softer Brexit?

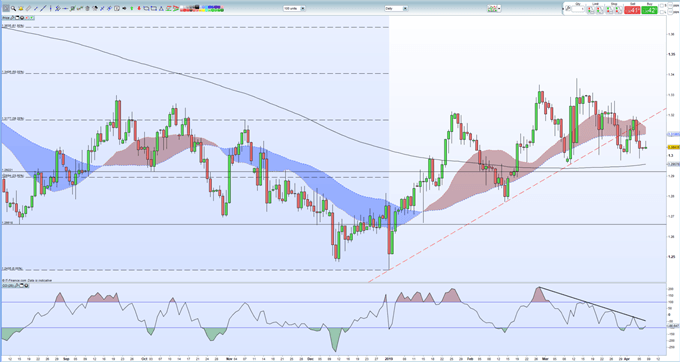

GBPUSD Daily Price Chart (August 2018 – April 8, 2019)

Retail traders are 71.8% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. See how recent daily and weekly positional changes affect GBPUSD sentiment.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.