Asia Pacific Markets Wrap Talking Points

- Asia Pacific stocks upside momentum fades

- Anti-risk Japanese Yen gains as Aussie falls

- Market mood may sour in the hours ahead

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Most Asia Pacific benchmark stock indexes lost their upside momentum to a certain extent after Monday’s rosy session. Gaps to the upside, such as in the Nikkei 225, struggled to be sustained as equities generally traded lower. This also followed gains on Wall Street and the S&P 500’s best performance in 3 weeks.

This is a sign of caution despite recent better-than-expected Chinese and US manufacturing PMI data. As a reminder, all was not well on the economic data front over the past 24 hours. We had softer US retail sales and a slew of disappointing European manufacturing PMI outcomes.

Check out the DailyFX Economic Calendar for the latest market-moving scheduled event risk

For a closer look at risk appetite, look no further than foreign exchange markets. The sentiment-oriented Australian and New Zealand Dollars weakened. The former was also mildly caught off guard by pessimistic hints from an RBA rate hold. The anti-risk Japanese Yen and US Dollar cautiously rose.

S&P 500 futures are pointing narrowly lower as we head for the European trading session, suggesting that Monday’s upbeat mood may pause. During the US session, keep an eye out for durable goods orders. Meanwhile, Brexit remains a wildcard with risks of a ‘no deal’ EU-UK divorce having just increased.

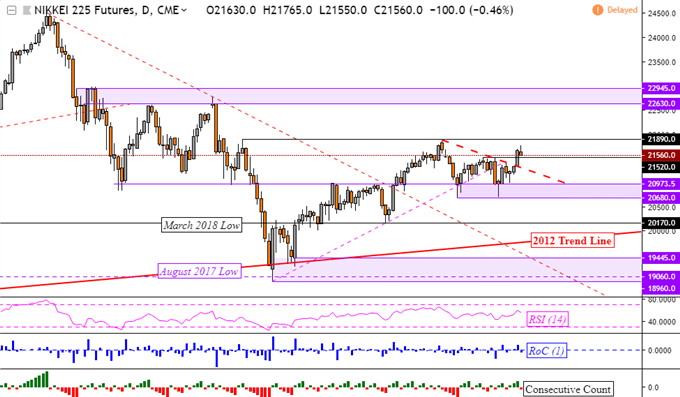

Nikkei 225 Technical Analysis

Taking a look at futures to show afterhours trade, the Nikkei 225 paused its break above a near-term falling resistance line from March. The index is eyeing former resistance at 21520 which may reinstate itself as support. Otherwise, I would like to see a push above 21890 to show dominant uptrend resumption from December.

Nikkei 225 Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter