Asia Pacific Markets Wrap Talking Points

- Shanghai Composite leads Asia stocks higher

- Canadian Dollar may rise rosy GDP report

- Nikkei 225 oscillation inching towards breakout

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Asia Pacific benchmark stock indexes traded cautiously higher in early Friday trade, though follow-through seemed to be lacking after initial gains. While the Nikkei 225 aimed about 0.70% to the upside heading into Tokyo close, it spent most of its day trading sideways. A similar performance was also seen in the ASX 200.

Chinese equities rallied the furthest, with the Shanghai Composite up over 2 percent. In Beijing, US Treasury Secretary Steven Mnuchin said that he had a ‘very productive’ dinner with officials ahead of the next phase of US-China trade talks.

The cautiously optimistic mood in markets weighed against the anti-risk Japanese Yen slightly. Meanwhile, the sentiment-geared Australian and New Zealand Dollars tepidly rose. GBP/USD slowly corrected previous Brexit-related losses.

Ahead, markets eye a data-packed ending to the week. Items such as Canadian GDP and US PCE core (the Fed’s preferred measure of inflation) are on the docket. The former may outperform, as data has been tending to in the nation. This may offer a lift for the Canadian Dollar.

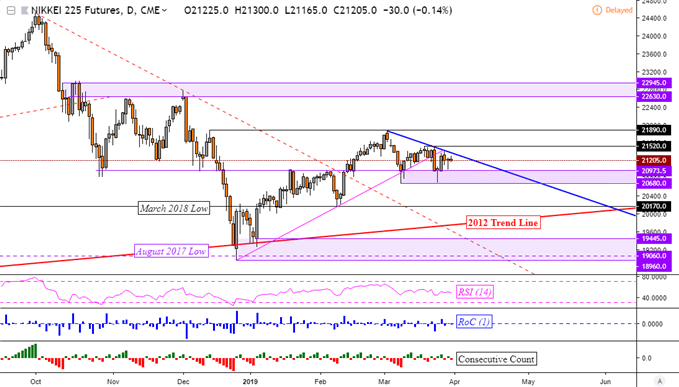

Nikkei 225 Technical Analysis

Using futures to show afterhours trade, the Nikkei 225 remains wedged in-between a falling trend line from early March and a range of support above 20680. The former seems to be guiding it lower, but a breakout in either direction seems to be approaching soon.

Nikkei 225 Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter