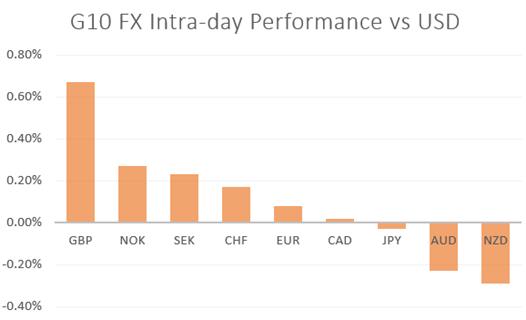

MARKET DEVELOPMENT – GBPUSD Recovers, AUDUSD Dips, EURUSD Rise Capped

GBP: After yet another large defeat for Theresa May’s deal, GBPUSD is notably firmer this morning. With tonight’s No-Deal Brexit vote likely to be rejected, and an extension to Article 50 likely to be favoured in tomorrow’s vote. However, while an extension to Article 50 may provide a lift to the Pound, gains are likely to be muted given that clarity of Brexit will continue to persist with a range of possibilities existing (General election, Second referendum, PM resignation etc). While GBP implied volatility has dropped ahead of tonight’s vote, headline risk remains with overnight vols implying a move of 106pips.

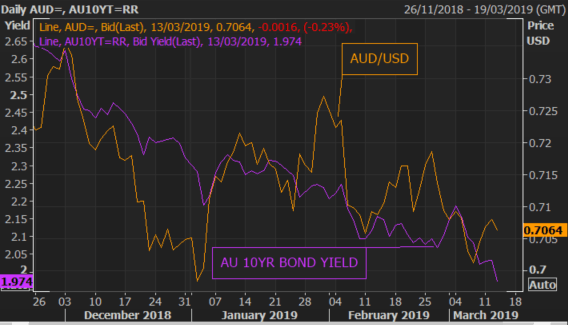

AUD: Domestic challenges within Australia have once again dented the Aussie as consumer sentiment dropped 4.8%, marking the lowest level since September 2015. Alongside this, Australian 10yr bond yields are now yielding less than 2%, consequently, upside in the Aussie is limited. However, the most important data for the near-term direction for the AUD will be released next, which comes in the form of the Aussie labour report, with close attention on the unemployment rate. The labour market remains one of the bright sparks in the economy, although a sizeable uptick in the unemployment rate could lead to fresh dovish signals from the RBA.

EUR: The Euro has been held within a tight 30pip range with 1.1300 capping for now. Reminder, $2.1bln worth of vanilla options are situated at 1.1300-1.1310. As such, while EURUSD has made an encouraging recovery from sub 1.1200 to 1.1300 since the ECB’s monetary policy decision, bund yields have failed to edge higher to confirm this bounce.

CHART OF THE DAY: AU 10YR SUB 2%

Source: Thomson Reuters

Source: Thomson Reuters, DailyFX

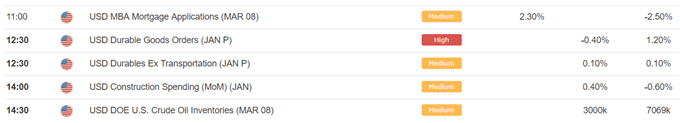

DailyFX Economic Calendar: – North American Releases

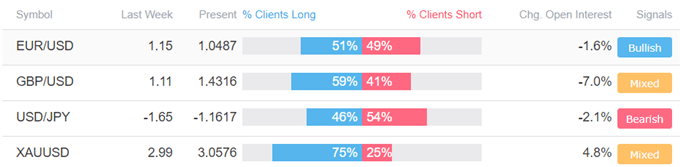

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “FTSE 100, S&P 500 Outlook: No-Deal Brexit Vote Likely Rejected” by Justin McQueen, Market Analyst

- “Crude Oil Price - Headwinds Persist Ahead of Multi-Month High” by Nick Cawley, Market Analyst

- “Trading Outlook for S&P 500, DAX, Gold Price, Crude Oil & More” by Paul Robinson, Market Analyst

- “GBPUSD Price: Brexit Deadline Extension Could be Good for Sterling” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX