EURO TALKING POINTS – EUR/USD, GERMAN FACTORY ORDERS, ECB

- Will the Euro move on German factory orders?

- “Steam engine” of Europe sputters and slows

- ECB cut growth outlook – uncertainty ahead

See our free guide to learn how to use economic news in your trading strategy !

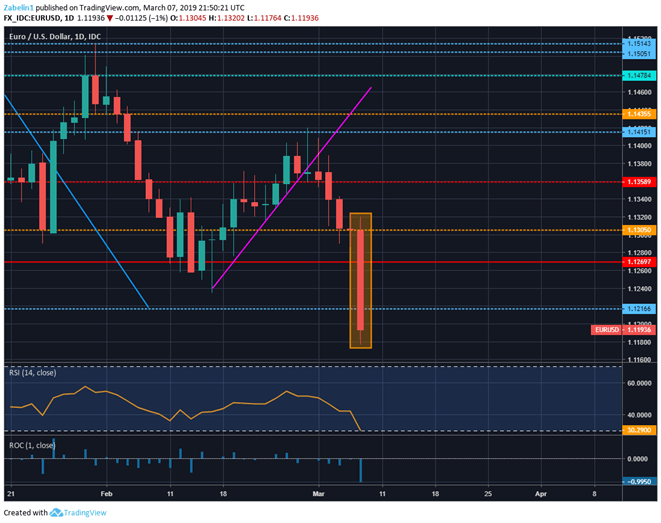

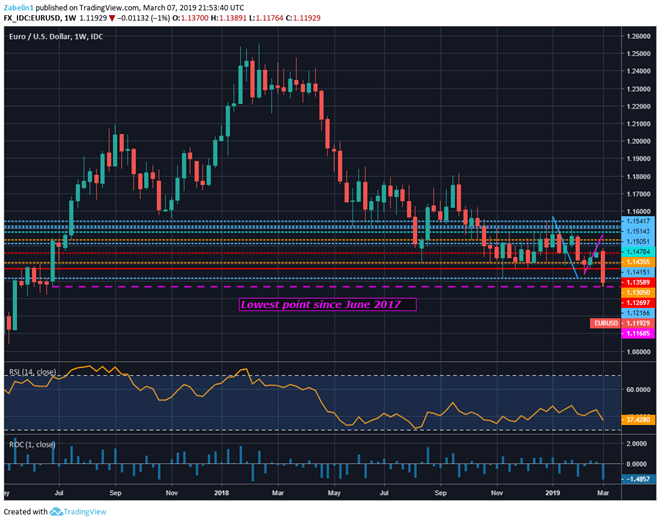

The Euro took a hit yesterday after the ECB announced it intends to hold rates throughout the rest of the year and plans to introduce liquidity provisions to counter the EU economic slowdown. EUR/USD plunged through the support at 1.1269 and broke through a key psychological barrier at 1.1216, the lowest point since June 2017.

EUR/USD – Daily Chart

EUR/USD – Weekly Chart

The ECB cut its inflation forecast for 2019 from 1.6 percent to 1.2 with central bank President Mario Draghi saying the risks to the economic outlook still remain tilted on the downside. This comes shortly after seasonally adjusted year-on-year GDP came in at 1.1 percent, undershooting the 2.2 forecast. As expected, Draghi also cited the increasing risk and uncertainty stemming from a shift in European geopolitics.

The upcoming German factory orders data is therefore important to monitor because it will serve as a key gauge to determine how producers in the largest Eurozone economy feel about the economic outlook. Forecasts are currently pegged at 0.5 percent with the previous showing a contraction of 1.6. Italian month-on-month industrial production may also warrant the attention of Euro traders because it may illuminate the level of demand in the recession-burdened economy.

Looking ahead, on the external front, policymakers will continue to watch for key risks from abroad such as the trade war negotiations between Washington and Beijing, the EU’s potential economic conflict with the US and slower growth in China. At home, EU officials will be monitoring the situation with Brexit and closely eyeing the political landscape as the continent approaches its most consequential EU-wide election to date.

EUR/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter