TALKING POINTS: USD/JPY, 4Q PRELIMINARY GDP, CPI, TRADE TALKS, BREXIT

- Japanese Yen pared slight gains in response to mixed 4Q preliminary GDP data

- USD/JPY nearing resistance levels at 110.995-111.564, gains may continue

- Japanese CPI, US-China trade talks, and Brexit developments in focus

The Japanese Yen cautiously gained against the US Dollar as local economic data crossed the wires early into Thursday’s Asia Pacific trading session. Preliminary annualized GDP for the fourth quarter came in at 1.4%, in line with the estimate and up from -2.6%. Meanwhile the initial seasonally adjusted growth figure for 4Q was 0.3%, a decline from the forecast of 0.4% but an improvement from the -0.6% prior. However, in spite of the mostly in-line data, the currency pair soon pared its losses.

USD/JPY 5-Minute Chart

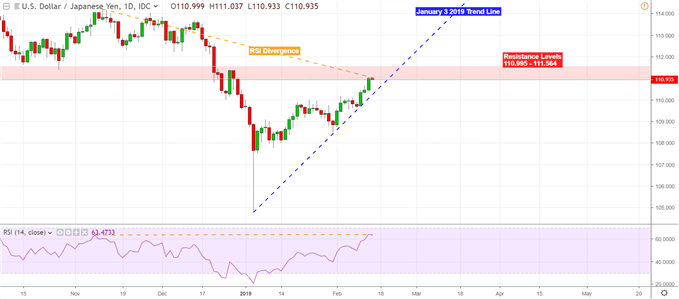

Despite the initial slight downtick in prices, the currency pair has rallied for the majority of this year and is currently testing resistance levels in the 110.995-111.564 range. Traders may look for confirmation via daily closing above this range, which may confirm positive RSI divergence. However, a break below the ascending January 2019 trend line may indicate further bearish momentum.

USD/JPY Daily Chart

Looking ahead, the currency pair will be closely eyeing the release of December’s month-on-month US retail sales, in addition to preliminary University of Michigan consumer sentiment for February. January’s Japanese CPI data may also offer next cues. Furthermore, equities’ reaction to fundamental themes will continue to dominate next moves, as US-China trade talks resume today and UK Prime Minister Theresa May continues to struggle to broker a Brexit deal.

USD/JPY Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Japanese Yen is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Megha Torpunuri, DailyFX Research Team