Asian Stocks Talking Points:

- Stocks were broadly higher on a Wall Street Journal report suggesting that the pace of US rate rises may slow

- The US Dollar slipped back a little on the same basis

- A key US labour report will dominate the rest of Friday

Find out what retail foreign exchange investors make of your favorite currency’s chances right now at the DailyFX Sentiment Page

Asian equity markets got some respite to end the week thanks to a report from the Wall Street Journal which suggested that US interest rates may not rise as fast as some had feared. The paper said that the central bank is mulling a ‘wait-and-see’ approach, and that officials are unsure as to what their next move will be after this month’s policy decision.

This story had brought Wall Street stocks off their lows in the previous session, and it seems to have supported local bourses too. The Nikkei rose 0.8%, with the Hang Seng up 0.2% in the middle of the Hong Kong afternoon. Shanghai stocks were up by a whisker with Sydney’s ASX 200 in the green by 0.4%.

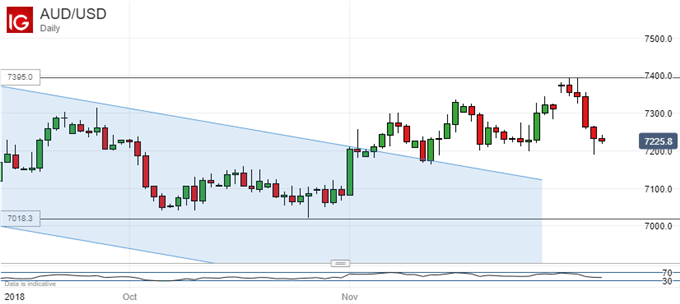

The US Dollar was broadly weaker thanks to the same market Federal Reserve prognosis that lifted stocks. Focus now will be on Friday’s official labor market report. Nonfarm payrolls are expected to have expanded by 198,00 in November, with the unemployment rate seen steady at 3.7%. The Australian Dollar remains pressured by a variety of foreign and domestic factors, not least this week’s disappointing growth report from its home country. AUD/USD has been wilting all week and now looks at risk of a return to the daily-chart downtrend which characterized much of this year’s trade. It is highlighted in blue on the chart below.

Gold prices look set for their strongest week since August, thanks to a broad fall in risk appetite even if that was no so evident Friday. Crude oil prices slipped on news that OPEC will make production cuts dependent on participation from non-member Russia.

Still to come on the day's economic data slate are German industrial production numbers, the Bank of England’s inflation look-ahead and news of Eurozone government spending. Canadian unemployment figures are also coming up, as is the Mexican Consumer Price Index and the University of Michigan’s consumer sentiment snapshot.

However all of those are likely to be mere warm-up acts for those US employment numbers.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!