Talking Points

- October US Pending Home Sales disappointed significantly, dropping by -2.6% m/m and -4.6% y/y, both well-below expectations.

- The data today fit in with the broader trend of underwhelming US housing data in 2018; pending home sales have declined on an annualized basis in 10 of the past 11 months.

- Traders remain focused on the release of the November FOMC meeting minutes later today as well as news from the G20 summit in Argentina that the US-China trade war is coming to an end.

See the DailyFX Economic Calendar and see what live coverage for key event risk impacting FX markets is scheduled for next week on the DailyFX Webinar Calendar.

As the Federal Reserve has tightened monetary policy and pushed interest rates higher, there has been one clear loser: the US housing market. The impact of rising mortgage rates against a backdrop of a multi-year stagnation in wages has diminished affordability, leaving prospective US homebuyers on the sidelines for the time being.

The -4.6% y/y decline in October US Pending Home Sales was a sizeable miss relative to expectations (-2.8%), and follows after yesterday’s disappointing October US New Home Sales report (-8.9% y/y). But the disappointing data is really just more of the same; Pending Home Sales have fallen, on an annual rates, in 10 of the past 11 months. Accordingly, Pending Home Sales has fallen back to its lowest level overall since June 2014.

The disappointing housing data fits in with what may be a new trend of weaker US economic data. Earlier in the day, US WeeklyJobless Claims rose back to their highest level in six months. Gauges of economic data momentum have started to deteriorate over the past few weeks, with the US Citi Economic Surprise Index dropping from +14 on November 16 (its high for the month) to -4.9 today (its lowest reading since -5.4 on October 15).

Here are the data driving the US Dollar this morning:

- USD Pending Home Sales (OCT): -2.6% versus +0.5% expected, from +0.7% (revised higher from +0.5%) (m/m)

- USD Pending Home Sales (OCT): -4.6% versus -2.8% expected, from -3.3% (revised higher from -3.4%) (y/y)

See the DailyFX Economic Calendar for Thursday, November 29, 2018.

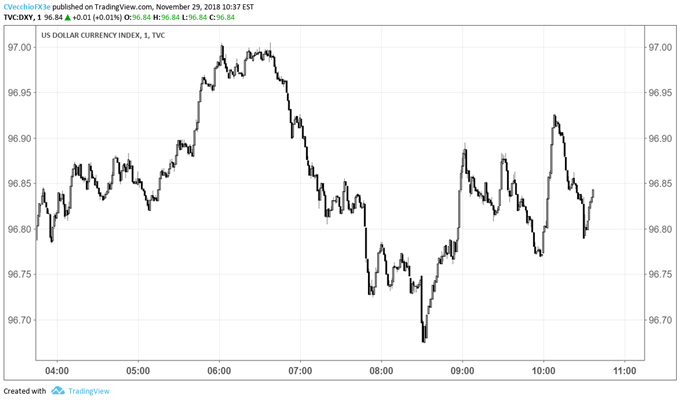

DXY Index Price Chart: 1-minute Timeframe (November 29, 2018) (Chart 1)

Following the inflation report, the US Dollar continued to trade within the range established between 11 and 13 GMT today, with the DXY Index trading in at 96.84 at the time this report was written. Around the data release, the DXY Index traded from 96.77 to as high as 96.92. Despite gains by EUR/USD and losses by USD/JPY today, the DXY Index continues to benefit from ongoing tension in the Brexit saga as GBP/USD losses remain ingrained.

Read more: DXY Index Hovers Below Yearly Highs Before Powell Speech

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides