GBPUSD price and sentiment analysis:

- Retail trader sentiment data show an increase in net-long GBPUSD positions.

- A contrarian view of crowd sentiment suggests that could mean further falls to come.

Retail traders increase GBPUSD net-long positions

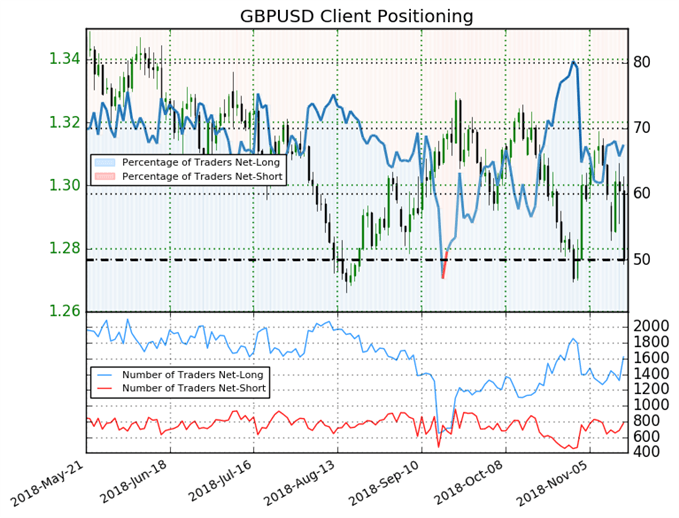

As GBPUSD falls on opposition to the proposed Brexit deal reached by UK Prime Minister Theresa May with the EU, retail trader data show that 67.6% of traders are now net-long the pair, with the ratio of traders long to short at 2.08 to 1. In fact, traders have remained net-long since September 20, when GBPUSD traded near 1.30463; the price has moved 2.1% lower since then. The number of traders net-long is 11.2% higher than yesterday and 18.0% higher from last week, while the number of traders net-short is only 0.5% higher than yesterday and 7.7% lower from last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests the GBPUSD price may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

More to read from earlier today:

Brexit Latest: Sterling Slumps as Brexit Minister Resigns, PM Leadership in Doubt

How Does a Leadership Challenge to a UK Prime Minister Work?

Further GBP Price Drop Likely as Brexit Deal Faces Strong Opposition

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex