GBP Analysis and Talking Points

- Wage Growth Continues to Accelerate

- Employment Report Mixed Overall

- Brexit Remains the Major Theme for GBP Price Action

See our Q4 GBP forecast to learn what will drive the currency through the quarter.

Wage Growth Continues to Accelerate

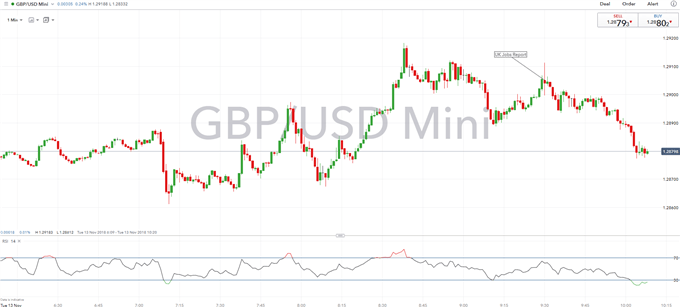

GBPUSD saw a choppy reaction level following the latest employment report with UK wages continuing to accelerate. The BoE focussed wage components rose above analyst estimates with the ex-bonus figure rising to the highest level since Q4 2008 at 3.2%, while the average weekly earnings saw its biggest rise since Q3 2015. This also backs up recent commentary from BoE’s Broadbent, who stated that wages are materially higher, which leads him to believe that signs of domestic inflation pressure is building. As a reminder, at the November Quarterly Inflation Report, the BoE upgraded their view on wage growth in 2018 to 2.75% from 2.5%.

Employment Report Mixed Overall

Overall, the employment report had been somewhat mixed, which in turn had seen GBP retrace its morning gains and make a break back below the 1.29 handle. While the employment change rose above expectations at 23k (Exp. 21k), the unemployment rate saw a surprise uptick to 4.1% with the claimant count also rising yet again. However, it is likely that data will continue to take a backseat for major Sterling pairs with Brexit at the critical stage in negotiations, with a deadline for an agreement between the EU and UK set for tomorrow in order for a November summit to take place. The UK Deputy Prime Minister provided some optimism after stating that a Brexit deal could be reached within the next 24-48 hours, which in turn lifted GBP to highs of 1.2917. Although, what has typically been the case is that Brexit optimism has been persistently faded.

ANALYST TRADE PICK

EURGBP: Pending Short - Downtrend Intact

Additional Brexit Analysis

- How does a leadership challenge to a UK Prime Minister work?

- Brexit Effect on Pound and UK Stocks: Impact of Deal or No Deal

GBPUSD CHART: 1-Minute Time-Frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX