USDJPY Analysis and Talking Points:

- USDJPY Remains Elevated with 114.00 the Topside Target

- Optimistic Fed Despite Market Turbulence to Boost USDJPY

- Large Speculative Shorts Leaves USDJPY Vulnerable

Brand New FX Forecasts for Q4

USDJPY Remains Elevated with 114.00 the Topside Target

In the wake of the midterm election, USD initially softened against the Japanese Yen, however, a rebound in equity markets, alongside notable support just south of the 113.00 handle saw USDJPY make a recovery with the pair trading in the mid-113s and subsequently eying a test of the 114.00 level. Given, that the dust has settled over the midterm election, focus now turns to the FOMC rate decision. The central bank is expected keep interest rates unchanged today while markets price in roughly an 80% chance of a 4th hike coming in December.

Optimistic Fed Despite Market Turbulence to Boost USDJPY

Since the September rate decision, stocks have dropped over 8%, which in turn could see the Federal Reserve highlight rising concerns over market uncertainty, consequently pressuring the US Dollar. However, with the Fed on course to continue tightening monetary policy and with economic data remaining robust, the Fed may dismiss concerns over recent market volatility and as such could see USDJPY buoyed.

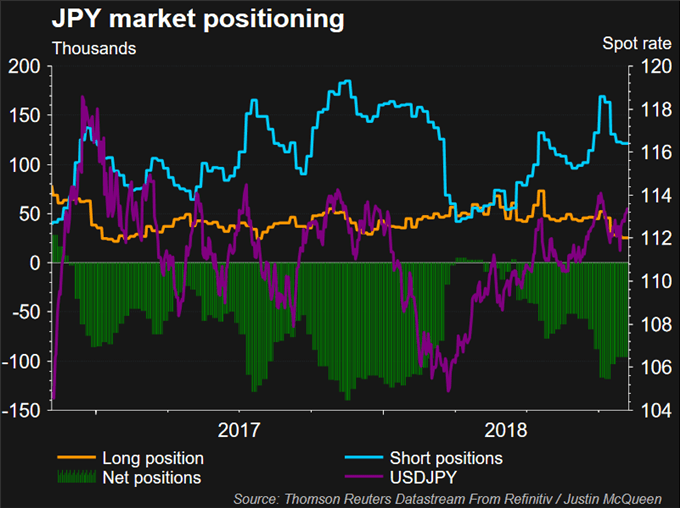

Large Speculative Shorts Leaves USDJPY Vulnerable

According to the latest CFTC, the Japanese Yen remains the largest net short against the US Dollar, which in turn implies that further gains in USDJPY may limited. As it stands, USD Long Positioning is at the highest level since December 2016, equating to roughly $28.76bln, whereby USDJPY makes up just over third of those positions. ($10.1bln).

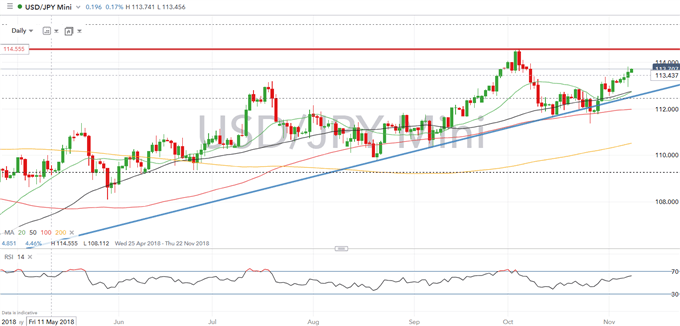

USDJPY PRICE CHART: DAILY TIMEFRAME (Apr-Nov 2018)

USDJPY remains buoyed by the rising trendline from the 2018 low (104.55), while support at 113.00 has opened up room for a test of the 114.00 handle. A close above increases scope for a move towards the YTD high 114.55.

JPY TRADING RESOURCES:

- See our quarterly JPY forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX