Market sentiment analysis:

- The Euro and the British Pound have both climbed against the US Dollar after the US mid-term elections that saw the Democrats win the House but the Republicans retain the Senate.

- Retail trader sentiment data suggest both those trends may now continue.

Sentiment data positive for EURUSD and GBPUSD after US mid-term elections

Both GBP and EUR could extend their advances against USD after the US mid-term elections, according to retail trader sentiment data.

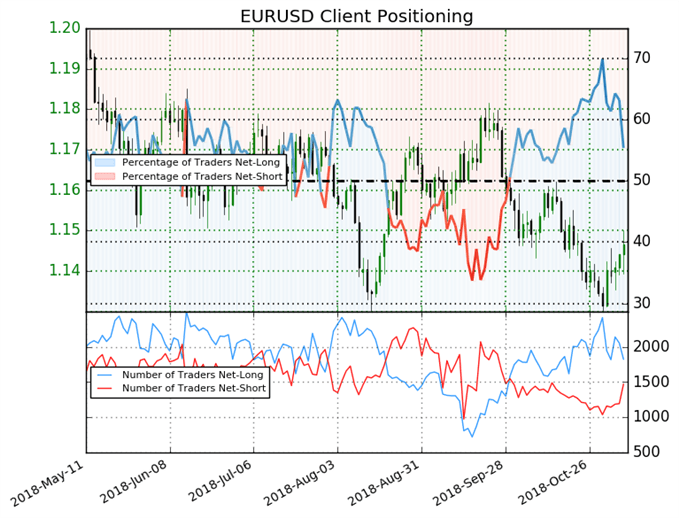

The figures for EURUSD show 55.4% of traders are net-long, with the ratio of traders long to short at 1.24 to 1. In fact, traders have remained net-long since October 1, when EURUSD traded near 1.16344; the price has moved 1.5% lower since then. The number of traders net-long is 20.3% lower than yesterday and 21.9% lower from last week, while the number of traders net-short is 16.6% higher than yesterday and 23.4% higher from last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon extend higher despite the fact traders remain net-long.

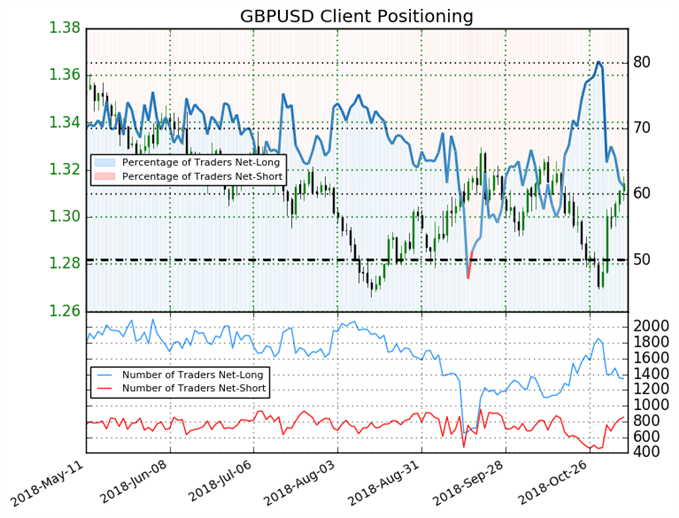

For GBPUSD, the data show 61.2% of traders are net-long, with the ratio of traders long to short at 1.58 to 1. In fact, traders have remained net-long since September 20, when GBPUSD traded near 1.31089; the price has moved 0.2% higher since then. The percentage of traders net-long is now its lowest since October 17, when GBPUSD traded near 1.31008. The number of traders net-long is 13.9% lower than yesterday and 28.8% lower from last week, while the number of traders net-short is 2.8% higher than yesterday and 59.6% higher from last week.

As we typically take a contrarian view to crowd sentiment, the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBPUSD price trend may also soon reverse higher despite the fact traders remain net-long.

Market forecasts after the US mid-term elections:

GBP and EUR Well Placed to Advance After US Mid-Term Elections

EURUSD Analysis: Resistance Curbs Further Upside, Eyes on FOMC

GBPUSD Price: Important Bullish Price Zone Nears

USD Price Lower in Europe After US Mid-Term Elections, May Fall Further

US Dollar May Turn Higher as Markets Digest Midterms Outcome

Asian Stocks Mostly Rise As Markets Digest US Midterm Vote

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex