EUR Analysis and Talking Points:

- EUR Grinds Higher on Midterm Election Outcome

- 1.15 the Stumbling Block For Now

- Euro Bulls Need Topside Break to Confirm 1.13 Bottom

See our quarterly EUR forecast to learn what will drive prices through mid-year!

EUR Grinds Higher on Midterm Election Outcome

The Euro has continued to track higher this morning, taking out the 50% Fibonacci Retracement at 1.1447 (rise from 1.0340-1.2555) and subsequently making test of the 1.15 handle. The Midterm election saw Republicans maintain a majority in the Senate, however, lost the House of Representatives to the Democrats, which in increases the likelihood of a political gridlock and thus has weighed on the US Dollar. Alongside this, the Trump administrations domestic agenda (Fiscal stimulus and tax reform) could face increased hurdles providing a USD negative outlook. Much of the upside in the Euro has stemmed from a bout of short covering with bearish bets at $4bln in the run up to the election.

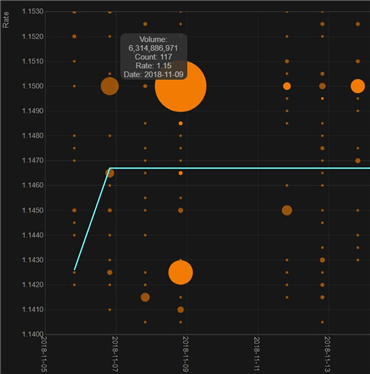

1.15 the Stumbling Block For Now

The upside in the Euro against the greenback has ran into notable resistance at the 1.15 handle with a huge 6.3bln vanilla option, which is set to expire on Friday, has curbed further upside in the pair for now. Alongside this, support is seen at 1.1425, whereby a 2.8bln vanilla option expiry sits at.

Source: Refinitiv. EURUSD option expiries via DTCC.

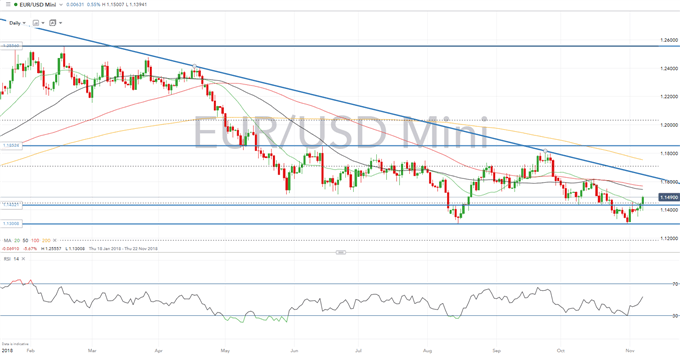

Euro Bulls Need Topside Break to Confirm 1.13 Bottom

Despite the notable rise from 1.13, to confirm a positive outlook for the pair, EURUSD bulls will be looking for a break and close above 1.1650. Consequently, with Italian politics, alongside an evident slowdown in the Eurozone remains prominent, while the Federal Reserve’s tighter monetary policy offers attractiveness for EURUSD shorts given the interest rate differential. The Euro still has some way to go before the outlook looks modestly bullish. Reminder, the latest FOMC meeting is scheduled tomorrow evening, whereby rates are expected to remain unchanged, however increased scrutiny may be placed on the IOER.

EURUSD PRICE CHART: Daily Time-Frame (Jan-Nov 2018)

TRADING RESOURCES:

- See our quarterly EUR forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX