Asia Pacific Market Open – Theresa May, Brexit, GBP/USD, US Dollar, US Services PMI

- Theresa May sent Sterling tumbling, calling Brexit negotiations with EU at an impasse

- US Dollar recovered after Thursday’s selloff, gains halted on weak services PMI data

- GBP/USD uptrend hangs by a thread: Bearish engulfing and break under a rising line

Find out what the #1 mistake that traders make is and how you can fix it!

The British Pound plummeted against all of its major counterparts on Friday as the latest Brexit news accelerated a selloff in Sterling that was already in progress. After Friday’s Asia Pacific trading session, the US Dollar slowly launched a recovery after Thursday’s lackluster performance. Haven bids poured into the liquid currency after European benchmark stock indexes pared some gains after gapping to the upside.

UK Prime Minister Theresa May, after being grilled by EU heads of state on her ‘Chequers’ exit plan the day before, then announced that they are at an impasse with negotiations with the European Union. She then highlighted that the UK will continue preparing for a no deal. Not only does this make working out a Brexit deal more unlikely by October, but it also increased the chance of a no deal outcome.

Broad weakness in Sterling likely aided to the US Dollar’s upside push as it become relatively more appealing. The Euro also lost ground against the greenback as a result. The anti-risk Swiss Franc saw cautious gains given the currency’s status as the favored European regional haven asset during market and political jitters.

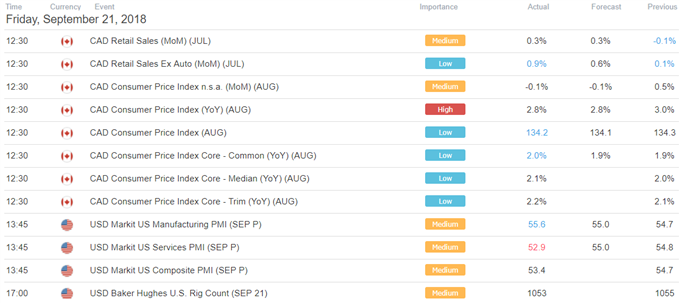

The Canadian Dollar traded mixed after a slightly better-than-expected local inflation report. Canada headline CPI clocked in at 2.8% y/y as expected in August but core CPI rose across the board. The US Dollar halted its ascent after the weakest preliminary estimate for Markit Services PMI since April crossed the wires. The index clocked in at 52.9 versus 55.0 expected and 54.8 in August.

Heading into the end of Friday’s trading session, the S&P 500 pared gains and closed slightly lower for the day at -0.04% after Asian and European shares finished the day broadly higher. With that in mind, APAC shares may trade relatively flat at the beginning of this week. The focus for them will be on risk trends given a lack of economic events. Meanwhile the Australian Dollar could rise to the February trend line next.

GBP/USD Technical Analysis – Uptrend About to End?

GBP/USD prices have clocked in their worst performance in a day since June 2017, falling about 1.53%. Simultaneously, the pair has formed a bearish engulfing reversal pattern with a break under a near-term rising support line. Further confirmation will be needed though that the dominant uptrend from mid-August is about to be overturned. Near-term support is a descending range of former resistance from May.

GBP/USD Daily Chart

Chart created in TradingView

US Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter