Asia Pacific Market Open – US Dollar, Emerging Markets, NZD/USD, New Zealand GDP Data

- US Dollar declines as market mood continues improving, emerging markets rally

- Crude oil prices brushed off smaller-than-expected DOE inventory contraction

- NZD/USD risks ending dominant downtrend if NZ GDP data beats expectations

See our study on the history of trade wars to learn how it might influence financial markets!

The US Dollar had a rather mixed session, finishing the day cautiously lower against its major peers. It declined during the first half of the day as market mood improved during the Asia and European trading sessions. Losses were pared though on the latest Brexit update from UK Prime Minister Theresa May which sent the British Pound lower despite prior gains on stronger-than-expected UK CPI data.

But the greenback came falling back down shortly after Wall Street opening bell where the S&P 500 rose and finished the day 0.13% higher. Demand for the world’s reserve currency also softened as the MSCI Emerging Markets ETF gapped and traded higher. This provided a boost to the perennially pro-risk currencies such as the Australian and New Zealand Dollars.

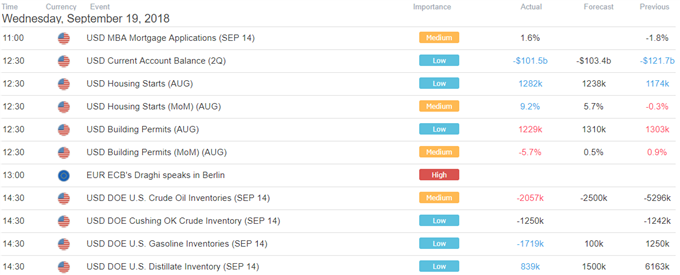

Meanwhile the anti-risk Japanese Yen and Swiss Franc underperformed. Sentiment-linked crude oil prices brushed off a smaller-than-anticipated contraction in official DOE inventories, focusing on the prevailing upbeat market mood. Anti-fiat gold prices also found upside momentum as the US Dollar generally finished the day lower.

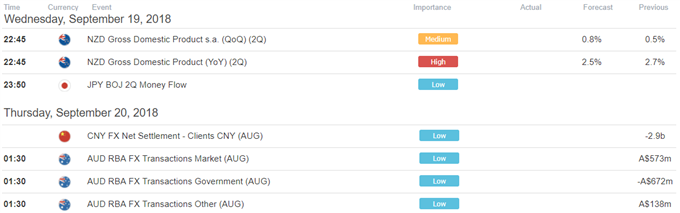

Ahead of Thursday Asia Pacific trade, the New Zealand Dollar is heading cautiously lower which may reflect pre-positioning for the second quarter GDP release. Do note that New Zealand economic news flow has been tending to outperform relative to economists’ expectations over the past couple of weeks. This may open the door to uplifting growth data which may undermine RBNZ rate cut bets.

NZD/USD Technical Analysis – Ready to Reverse Dominant Downtrend?

On a daily chart, NZD/USD prices have closed above the descending resistance line from mid-June. This may open the door to a reversal of the dominant downtrend since April. This would place 0.6714 – 0.67213 as the near-term target. Do keep in mind though that there was a false breakout above the line back in late August. Confirmation will be needed via more progress to the upside above the line.

NZD/USD Daily Chart

Chart created in TradingView

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter