Check out the brand new DailyFX trading forecasts for Q3

MARKET DEVELOPMENT – TRY BOOSTED ON DELIGHTFUL RATE HIKE

USD: As was the case with yesterday’s PPI report, the latest inflation readings underwhelmed economic forecasts with the headline reading dropping 0.2ppts to 2.7%. Consequently, the USD is trading softer against its major counterparts as hopes of an aggressive monetary tightening stance from the Federal Reserve recede. However, despite the softer inflation prints, expectations for 2 more rate rises this year are relatively unchanged.

TRY: The Turkish Lira is notably firmer after the Turkish Central Bank delivered a 625bps rate hike to 24% surpassing expectations of a 425bps rise. This was also despite comments President Erdogan who stated that interest rates should be lowered prior to the rate decision. Alongside this, the Turkish Central Bank noted that they would tightening monetary policy further in order to bring down inflation, which is currently tracking at the highest level since 2003.

EUR: Given the source reports yesterday that the ECB would lower growth forecasts and keep inflation forecasts unchanged. The ECB meeting itself had a relatively impact on the Euro, as such, focus had turned towards President Draghi’s presser, whereby the ECB President dismissed the spillover effects from the turbulence in emerging markets, namely, Turkey and Argentina.

GBP: A relatively muted affair with the Bank of England who stood pat on monetary policy. In turn, minimal reaction had been seen in the Pound with the central bank providing a somewhat balanced statement. The BoE had acknowledged that Brexit risks had increased since the prior meeting, although, highlighted that provided the economy grows as forecast, further tightening will be warranted. The Pound however has made a break above 1.31 following reports that the UK and EU have made progress on key Brexit issues.

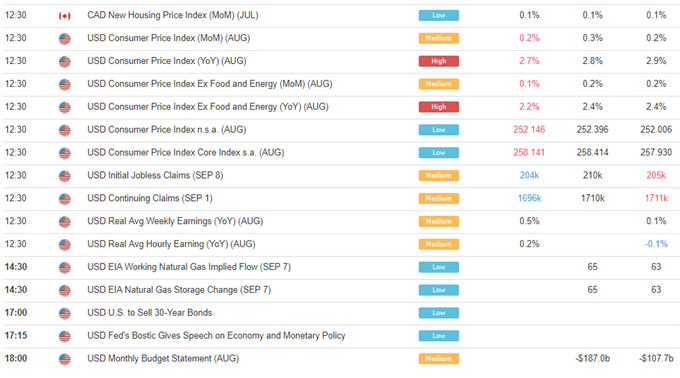

DailyFX Economic Calendar: Thursday, September 13, 2018 – North American Releases

DailyFX Webinar Calendar: Thursday, September 13, 2018

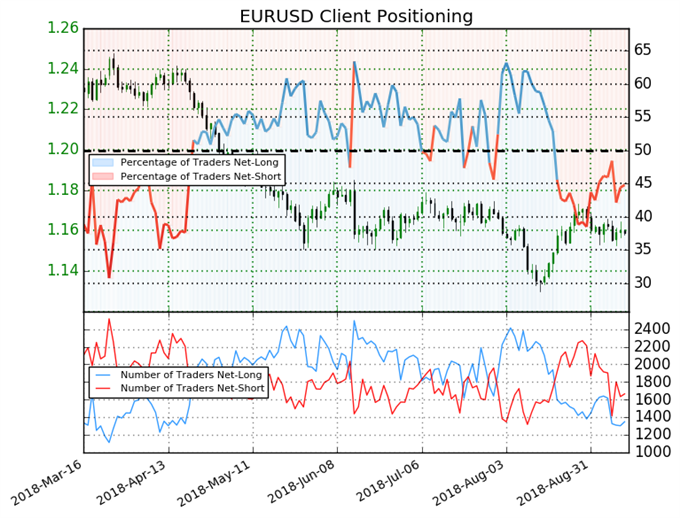

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 44.8% of traders are net-long with the ratio of traders short to long at 1.23 to 1. In fact, traders have remained net-short since Aug 21 when EURUSD traded near 1.14918; price has moved 0.8% higher since then. The number of traders net-long is 2.0% higher than yesterday and 17.0% lower from last week, while the number of traders net-short is 6.8% lower than yesterday and 17.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “EURUSD Nudges Lower After ECB Stands Pat: Press Conference Ahead” by Nick Cawley, Market Analyst

- “GBP Stable as Bank of England Leaves UK Interest Rates Unchanged" by Martin Essex, MSTA, Analyst and Editor

- “GBPUSD Price Analysis: Short-Term Uptrend Remains in Place” by Nick Cawley, Market Analyst

- “USDTRY May Hit Record High on Turkish Central Bank Inaction” by Justin McQueen, Market Analyst

- “Bitcoin and Ethereum Price Analysis: Buyers Beware” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com Follow Justin on Twitter @JMcQueenFX