GBP Analysis and Talking Points

- GBPUSD Weaken as Wage Growth Disappoints, Despite Falling Unemployment Rate.

- Brexit Talks Resume Thursday, Tory Brexiteers Plan Hard Brexit.

See our Q3 GBP forecast to learn what will drive the currency through the quarter.

GBP Softer as Wage Growth Disappoints

GBPUSD saw a mixed reaction towards the latest UK jobs reports. The pair had initially risen 30 pips to session highs of 1.2828 as the unemployment rate fell 0.2ppts to 4% (Lowest since 1975), which is below the Bank of England’s most recent NAIRU forecast of 4.25%. However, the wage components yet again disappointed the BoE with average weekly earnings at 2.4%, missing expectations of 2.5%. Elsewhere, the employment change rose a modest 42k, although failed to reach estimates of 98k. Consequently, GBPUSD is back at pre-announcement levels with the pair trading just south of the 1.28 handle.

Brexit Talks Resume

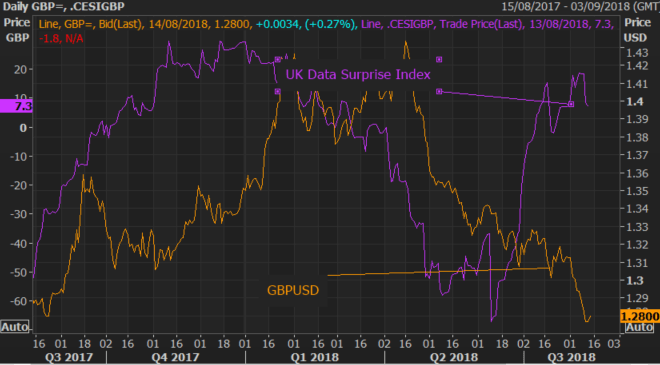

The focus for GBP is Brexit, which has been evidenced by the improvement in data since mid-June, reflected in the UK Data Surprise Index. However, GBP has continued to soften as markets pay attention to the latest developments surrounding Brexit. Consequently, as Brexit talks resume on Thursday, this may indeed dictate sentiment for the Pound. Elsewhere, reports from UK press this morning noted that Tory Brexiteers are said to be planning to challenge PM May by publishing their own blueprint favouring a hard Brexit, which will be published next month. This is also expected to have the backing of 60-80 Conservative MPs.

Source: Thomson Reuters

GBP/USD PRICE CHART: 1-Minute Time-Frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX