GBPUSD Analysis and News

- Bank of England Raises Rates to 0.75% in Surprise 9-0 Vote Split

- However, Bank of England Signals No Rush for Next Rate Hike

For a more in-depth analysis on Sterling, check out the Q2 Forecast for GBP/USD

Bank of England Hikes Rates to 0.75%

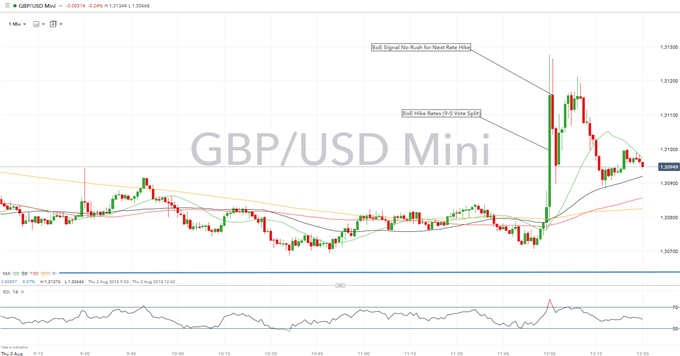

As markets had expected the Bank of England hiked the bank rate by 25bps to 0.75%, however, what was unexpected was the vote split, which had surprised with a 9-0 vote (Exp. 7-2 vote). As such, this had provided an initial lift to the Pound, with GBPUSD rising 40pips to 1.3129. However, gains were quickly reversed with the BoE signaling no rush for the next rate hike given the uncertainty surrounding Brexit, which the central bank noted that the Brexit responses could influence policy significantly. As such, the implied rates curves is relatively unchanged with another hike not fully priced in until September 2019.

Bank of England Forecast

| Forecasts | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| GDP | 1.5% (Prev. 1.4%) | 1.8% (Prev. 1.7%) | 1.7% (Prev. 1.7%) | 1.7% |

| CPI | 2.5% (Prev. 2.4%) | 2.2% (Prev. 2.1%) | 2.1% (Prev. 2%) | 2% |

Source: Bank of England

Cautious Growth and Inflation Judgements

The MPC recognized that growth in Q2 had shown a pickup from the soft data in Q1, as such, they continue to expect a pick up to 0.4%, which is still relatively subdued, while business surveys have suggested Q3 growth will be similar. In regard to inflation, the MPC noted that the 2.4% in June was below the bank’s forecasts, adding that this signals slightly weaker inflation pressures. As such, this is a rather cautious rhetoric out of the Bank of England.

GBP/USD PRICE CHART: 1-Minute Time Frame (August 2nd)

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX