TALKING POINTS – YEN, TRADE WAR, TARIFF, AUSSIE DOLLAR, NZ DOLLAR

- Yen may rise amid trade war fears as US mulls tariff on auto imports

- Australian Dollar gains following upbeat local labor market figures

- New Zealand Dollar declines after yields drop at 2037 bond auction

The return of trade war jitters may overshadow a lackluster offering of economic data in European and North American trading hours. The US Commerce Department will begin hearings on its investigation of whether auto imports pose a threat to national security. The Trump administration is pondering raising tariffs on these grounds having used similar logic to increase duties on aluminum and steel.

Headline flow suggesting US Commerce Secretary Wilbur Ross and company intends to lay out a case for increasing protectionism may undermine risk appetite across financial markets. In the G10 FX space that may be most directly reflected in a rising Japanese Yen as souring sentiment inspires the unwinding of carry trades funded in the perennially low-yielding currency.

Background - A Brief History of Trade Wars, 1900-Present

The Australian Dollar outperformed in Asia Pacific trade, rising following an impressive set of labor-market data. The currency rose alongside local bond yields, hinting the outcome was read as supportive for RBA interest rate hike speculation. Still, an increase is not priced in until the second half of next year and technical positioning continues to favor weakness.

Conversely, the New Zealand Dollar turned broadly lower after the average yield fell at an auction of 2037 government bonds. It registered at 3.173 percent, down from 3.263 percent when comparable paper was sold a month ago. Traders may have interpreted the outcome as pointing to a dovish shift in prevailing RBNZ interest rate hike expectations.

See our free guide to learn how to use economic news in your trading strategy !

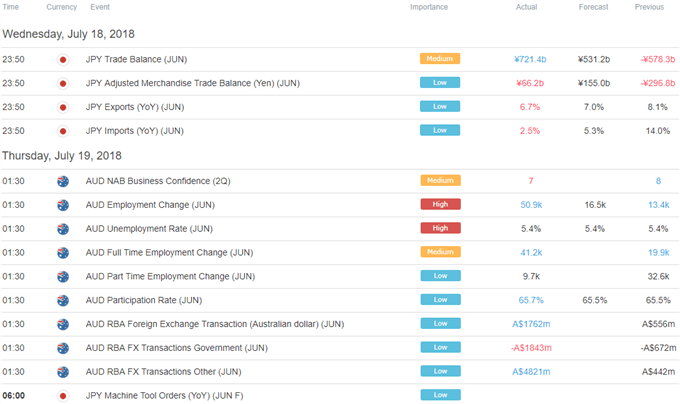

ASIA PACIFIC TRADING SESSION

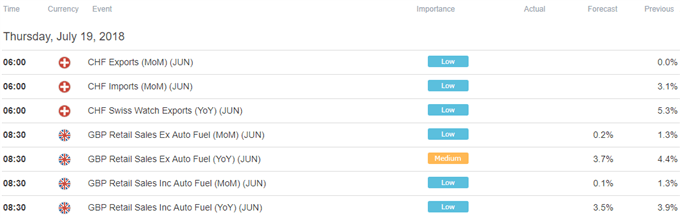

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter