GBP Prices, News and Analysis

- Brexit votes represent a very real risk for UK PM Theresa May’s political survival.

- UK hard data may underpin Sterling but politics are firmly in control this week.

DailyFX Q3 Trading Forecasts have just been released for a range of currencies and commodities, including GBP and USD.

GBP Will Dance to The Brexit Tune

It’s likely to be a long week for UK PM Theresa May as Conservative hardliners ready themselves for clashes over the UK’s recent Brexit negotiation bill. Last week’s White Paper disappointed many Brexiteers who will get a chance to scupper the proposal over the next two days when various bills are voted on in Parliament. With PM May’s position under increasing scrutiny, any further defeats on the Brexit proposal could spark a vote of confidence which would ultimately lead to her demise. The EU are also expected to comment on the UK’s White Paper and any further demands for concessions may well derail the process for good.

GBP Hard Data May Prove Supportive for The British Pound

A slew of UK data this week with all eyes on Tuesday’s employment and wages release and Wednesday’s inflation numbers. In addition, BOE’s Carney, Cunliffe and Stheeman testify to the Treasury Select Committee on Tuesday on the Financial Stability Report. UK employment is expected to remain at a near four-decade low while inflation is likely to edge higher, fueling thoughts that the UK central bank may hike rates at the next MPC meeting on August 2.

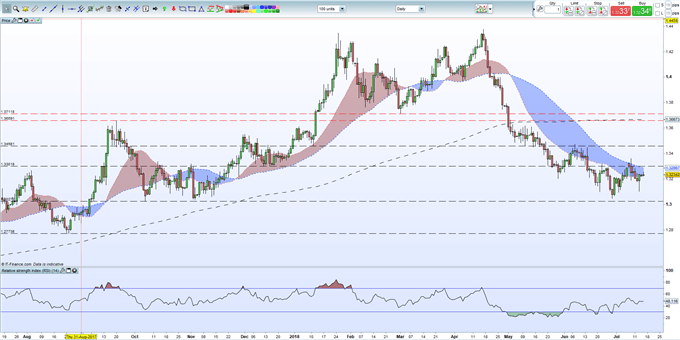

GBPUSD Remains on Edge

The British Pound is likely to remain volatile over the next few session and traders should watch out for various levels of support and resistance:

Support Levels - - 1.30493 (June 28 low) and 1.30272 (Fibonacci retracement)

Resistance Levels - - 1.33018 (Fibonacci retracement) and 1.33633 (July 9 high)

IG Client Sentiment shows traders are net-long GBPUSD, a bearish contrarian trading bias.

GBPUSD Daily Price Chart (July 2017 – July 16, 2018)

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1