AUD Analysis and News

- AUD Outlook Dampened by Rising US-China Trade War Tensions

- AUD Short Bets at the Highest Level Since December 2015

Escalating Trade War Tensions Dampens AUD Outlook

Increasing concerns over a full-blown trade war between the US and its largest trading partners (China and the EU) have been at the forefront of investors’ minds. The tit-for-tat trade spat with the US and China have shown no significant signs that either party will back down, as such, the Australian Dollar has come into the crossfire, given its large exposure to the Chinese economy and with trade war uncertainty set to continue in the months ahead, the AUD could grind lower. Additionally, AUDUSD downside is clear in option markets with 1-month risk reversals highlighting that AUD put bias is at the highest since February.

Background: Impact of Trade Wars click here

CFTC Speculative Positions Shows AUD Shorts Increased

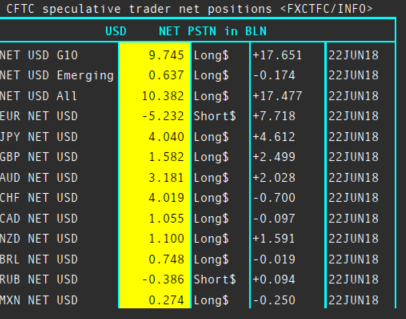

The negative sentiment stemming from rising trade war tensions has been reflected in market positioning with the latest CFTC speculative data showing that investors are the most bearish on the Australian Dollar since December 2015, which in turn has seen net AUD shorts equating to $3.181bln.

Source: Thomson Reuters (CFTC Speculative Positioning)

AUDUSD PRICE CHART: DAILY TIME FRAME (February 2017-June 2018)

AUDUSD currently holding above 0.7400, however with RSI indicators shifting towards further downside, a test of the 0.7400 handle looks to be on the cards. AUD bears looking to make a run in on 0.7330-40 support zone, whereby a close below could to a move towards 0.7200.

According to IG Sentiment, AUDUSD may continue to fall. For more information of client positioning, click here

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX