TALKING POINTS - NEW ZEALAND DOLLAR, GDP, RBNZ, TRADE WAR, CHINA

- New Zealand Dollar little-changed after in-line Q1 GDP data

- US-China trade war news flow likely to be in focus from here

- Critical NZD/USD support remains in the 0.6781-0.6862 area

Join a DailyFX webinar to track the impact of key economic data on currency trends!

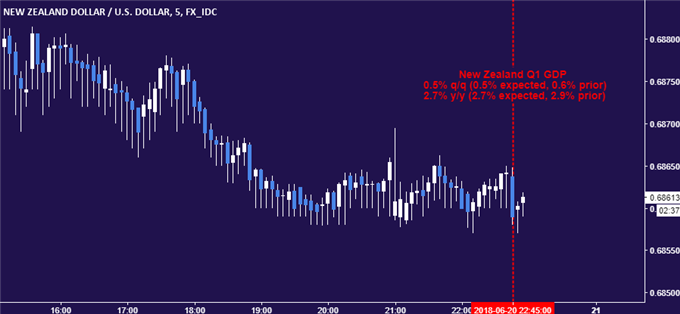

The New Zealand Dollar was little changed as first quarter GDP data crossed the wires in line with economists’ forecasts. Output added 0.5 percent in the three months to January, pushing the trend growth rate to 2.7 percent on-year. That matches the four-year low set in the third quarter of 2017.

The outcome probably did little to alter established RBNZ policy bets, explaining the post-data standstill. As it stands, the markets are pricing in a meager 11.6 percent probability of an interest rate hike in 2018. Bank Bill futures imply that the next increase will come late in the fourth quarter of next year.

This may put US-China trade war concerns back in focus. The frequently sentiment-linked currency has suffered along with most “risky” assets amid a heated exchange between Washington and Beijing in recent days. Soundbites from officials on both sides of the dispute may remain a source of near-term volatility.

Background - A Brief History of Trade Wars, 1900-Present

NZD/USD TECHNICAL ANALYSIS

Looking at overall technical positioning, prices are testing long-standing range support in the 0.6781-0.6862 area that has bedeviled sellers since late December 2016. A daily close below this juncture is needed to make the case for lasting downside follow-through. Near-term inflection point resistance is at 0.6965, with a reversal above that eyeing a retest of the June 6 high at 0.7060.

NZD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter