GBP talking points:

- First it was reported that the UK is ready to stay in the EU customs union beyond 2021.

- Then UK Prime Minister Theresa May denied the report.

- The lack of response in GBPUSD suggests that a move higher to recover a substantial percentage of the past month’s losses is not yet on the cards.

Check out the IG Client Sentiment data to help you trade profitably.

And for a longer-term outlook take a look at our Q2 forecast for GBP.

Brexit news fails to lift Sterling

A report in The Telegraph newspaper that the UK is prepared to stay in the EU customs union beyond 2021, and its subsequent denial by UK Prime Minister Theresa May, have failed to prompt substantial moves in GBPUSD. This suggests that after its sharp falls in the second half of April, and its subsequent relative stability, the pair is not yet well placed to shift out of its current narrow trading range.

GBPUSD Price Chart, Daily Timeframe (December 5, 2017 – May 17, 2018)

A decision to stay in the customs union for longer would likely be positive for the British Pound because it would point to a soft Brexit. However, as the five-minute chart below shows, the currency neither gained much ground on the report nor lost much when it was denied.

GBPUSD Price Chart, Five-Minute Timeframe (May 15, 2018 – May 17, 2018)

One reason could be that the UK governments continues to struggle to come up with an agreed Brexit position to put to the EU. Its flagship Brexit bill has now suffered 15 defeats in the House of Lords and the devolved Scottish parliament has refused to give its consent to the EU Withdrawal Bill. Moreover, talk of a leadership challenge to May has resurfaced – all adding to the lack of support for GBP at a time when previously expected interest rate increases have been put on the back burner.

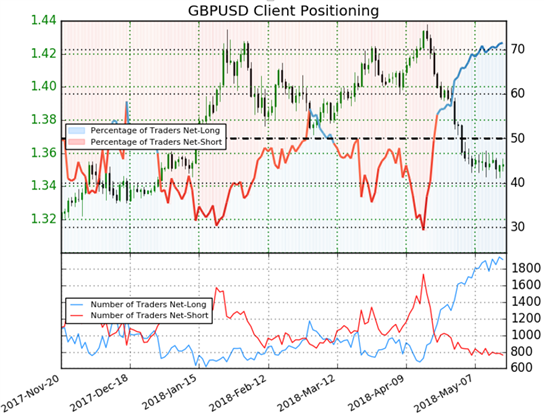

Moreover, retail trader data show 71.5% of traders are net-long, with the ratio of traders long to short at 2.51 to 1. In fact, traders have remained net-long since April 20, when GBPUSD traded near 1.4205; the price has moved 4.7% lower since then. The number of traders net-long is 1.5% higher than yesterday and 1.5% higher from last week, while the number of traders net-short is 6.7% lower than yesterday and unchanged from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

However, from a purely technical standpoint, the January low at 1.3458 is still providing support for GBPUSD while the 14-day relative strength index (RSI) has moved back to just above oversold territory.

Resources to help you trade the forex markets

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance, and one specifically for those who are new to forex. You can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex