Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The US Dollar has started the week on slightly higher footing, recovering more ground as the prospect of steep tariffs on the United States’ major trading partners has simmered. The Euro continues to lose ground following the ECB rate decision on Thursday in which policymakers made clear that interest rates wouldn’t be rising any time soon. The British Pound has rallied in recent hours as reports emerged that the UK and the EU were close to reaching a transition deal for Brexit. Otherwise, with the ides of March quickly approaching, traders are paying more attention to the news wire than the calendar given the latter’s lack of meaningful capacity this week.

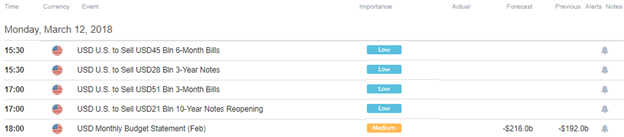

DailyFX Economic Calendar: Monday, March 12, 2018 – North American Releases

Monday kicks off a calmer week on the economic calendar with no Canadian data and only one US release, the Monthly Budget Statement for February. Otherwise, there are two bill sales and two note sales which have the potential of impacting bond markets and thus the US Dollar. Tomorrow, February inflation figures are due out from the United States, which should draw traders’ attention ahead of the FOMC meeting next Wednesday.

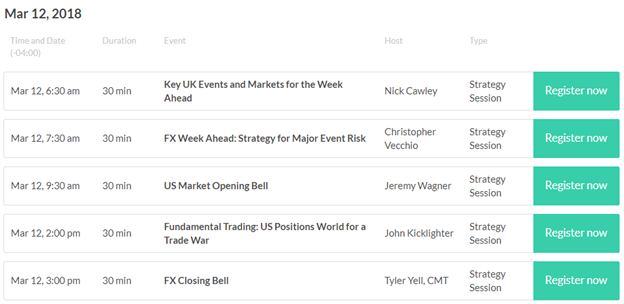

DailyFX Webinar Calendar: Monday, March 12, 2018

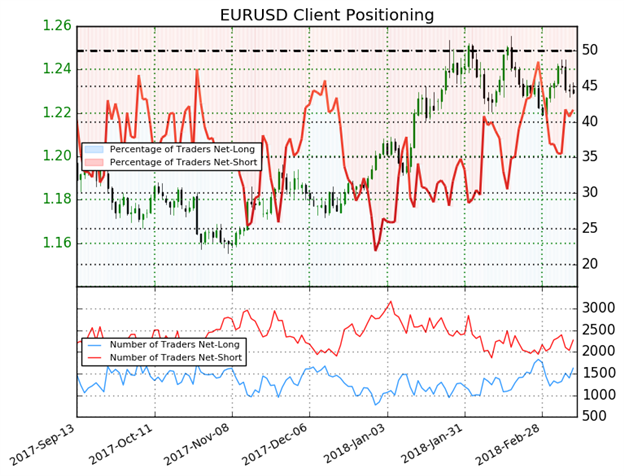

IG Client Sentiment Index Chart of the Day: EURUSD

EURUSD: Retail trader data shows 41.7% of traders are net-long with the ratio of traders short to long at 1.4 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.05498; price has moved 16.5% higher since then. The number of traders net-long is 11.0% higher than yesterday and 24.2% higher from last week, while the number of traders net-short is 6.7% higher than yesterday and 4.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Five Things Traders are Reading

- “FX Markets Turn to US CPI & Retail Sales, Kiwi GDP, SNB Rate Decision” by Christopher Vecchio, CFA, Senior Currency Strategist

- “UK Market Webinar: No Data But Brexit May Still Provide Volatility” by Nick Cawley, Analyst

- “GBP Traders Should Keep an Eye on Tuesday’s UK Spring Statement” by Martin Essex, MSTA, Analyst and Editor

- “Cryptocurrency Charts: Ethereum & Ripple, Old Support Becomes New Resistance” by Paul Robinson, Market Analyst

- “DailyFX Live Discussion With Ethereum Former CCO Stephan Tual” by Nick Cawley, Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.