To get the Asia AM Digest every day, SIGN UP HERE

The Euro shot higher amid signs that progress is being made in German coalition talks on Friday. A preliminary deal between Chancellor Angela Merkel and the center-left SPD is reportedly in place, though further talks are still ahead. Meanwhile, the British Pound rose on reports that Spanish and Dutch officials were working behind the scenes to ensure that the post-Brexit UK/EU relationship is as close as possible.

The Australian and New Zealand Dollars declined, with the latter currency proving to be the weakest on the day among its G10 FX counterparts. The two currencies were already drifting lower when slightly upbeat US CPI data sent Treasury rates higher, undermining their yield appeal. Earlier losses seemed corrective after the Aussie hit a two-month high while the Kiwi touched the strongest level since late September.

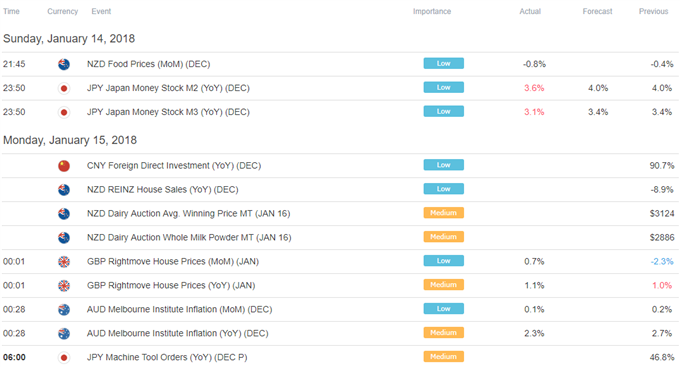

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

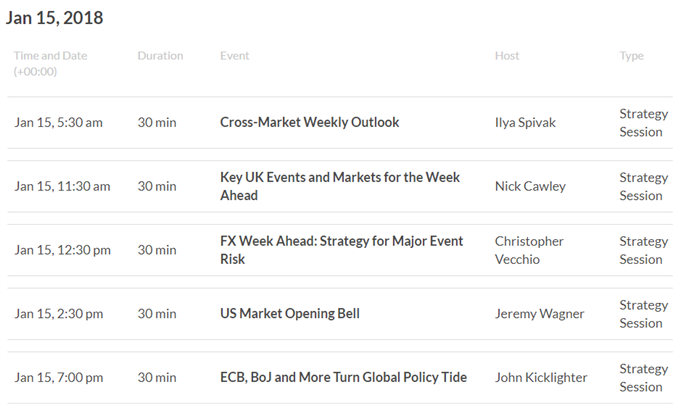

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

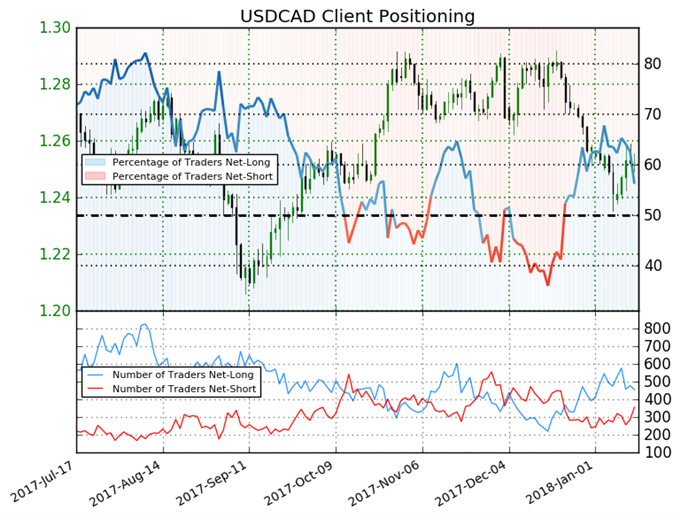

IG Client Sentiment Index Chart of the Day: USD/CAD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 56.2% of traders are net-long USD/CAD, with the ratio of traders long to short at 1.28 to 1. In fact, traders have remained net-long since Dec 21 when USD/CAD traded near 1.2875; price has moved 2.7% lower since then. The percentage of traders net-long is now its lowest since Dec 27 when USD/CAD traded near 1.26502. The number of traders net-long is 9.5% lower than yesterday and 20.4% lower from last week, while the number of traders net-short is 31.4% higher than yesterday and 28.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- Weekly Trading Forecast: Markets Chase Rate Hikes Outside the US by DailyFX Research Team

- Risk Rally is Really a S&P 500 Rally, Dollar Collapse a EUR/USD Breakout by John Kicklighter, Chief Currency Strategist

- EUR/USD Celebrates to Highest Level in 3 Years; The Party May Not Last by Jeremy Wagner, CEWA-M

- EUR/USD Weekly Chart Analysis: Euro May Find Limited Follow-through by Paul Robinson, Market Analyst

- Will the Euro and Pound Trigger the Dollar’s Tumble? by John Kicklighter, Chief Currency Strategist

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here