Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The US Dollar put in a mixed performance against its G10 FX counterparts after an FOMC monetary policy announcement in line with market expectations left markets to mull the nomination of the next Fed Chair. President Donald Trump is set to unveil his decision on that score later today.

The New Zealand Dollar outperformed on the day, managing to hold on to most of the gains scored in the aftermath of surprisingly strong third-quarter labor market data. The Australian Dollar likewise found support while funding currencies the Yen and Swiss Franc suffered as a risk-on mood prevailed for most of the day (although a significant mid-session reversal pushed benchmark assets away from intraday extremes).

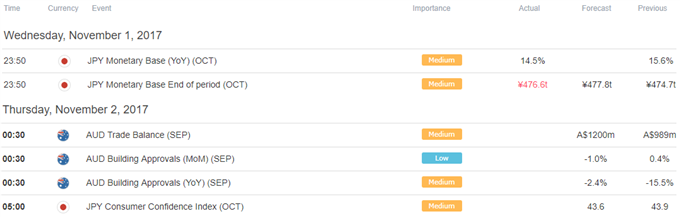

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

Australian trade balance and building approvals statistics headline a quiet economic calendar in Asia Pacific trading hours. Local economic data has increasingly deteriorated relative to consensus forecasts in recent months, opening the door for further downside surprises. The Aussie Dollar may not see a significant response one way or another however considering RBA policy expectations look to be firmly anchored in the near term. Markets do not expect to see a change in rate at least until August 2018.

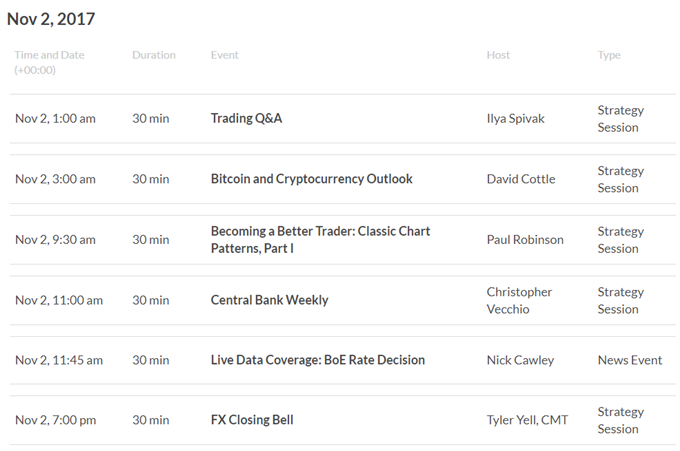

DailyFX Webinar Calendar – CLICK HERE to register

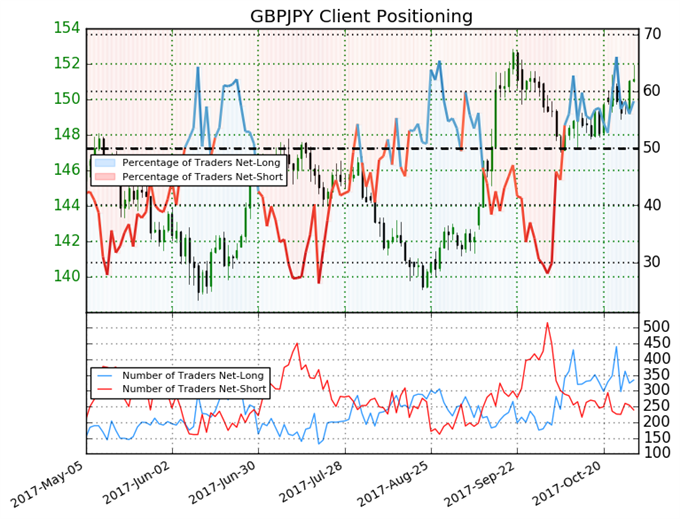

IG Client Sentiment Index Chart of the Day: GBP/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 58.3% of traders are net-long GBP/JPY, with the ratio of traders long to short at 1.4 to 1. In fact, traders have remained net-long since Oct 24 when GBP/JPY traded near 150.739; price has moved 0.3% higher since then. The number of traders net-long is 5.6% lower than yesterday and 8.5% lower from last week, while the number of traders net-short is 3.9% higher than yesterday and 9.6% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- Here’s How the Next Fed Chair Will Impact Policy, FX Markets by John Kicklighter, Chief Strategist and Dylan Jusino, DailyFX Research

- US Dollar Steady as FOMC Holds on Rates, December Rate Hike on Track by Christopher Vecchio, CFA, Sr. Currency Strategist

- GBP/USD Rebound to Face FOMC, BoE, NFP- Levels to Know by Michael Boutros, Currency Strategist

- Bitcoin Trading Strategy as Prices Continue to Surge by Nick Cawley, Analyst

- E UR/USD Head-and-Shoulders Unfolds Ahead of U.S. Non-Farm Payrolls (NFP) by David Song, Currency Analyst

To get the Asia AM Digest every day before the Tokyo cash equity open, sign up here

To get the US AM Digest every day before the US cash equity open, sign up here

To get both reports daily, sign up here