Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The US Dollar is advancing for third consecutive day, despite a light flow of data to the start of the week. Fed rate hike expectations have been rising since Friday, now up to an 82% implied probability of a 25-bps hike in December, up from 75% last week. Concurrently, US Treasury yields continue to rise, with the 2-year yield pushing to fresh yearly highs and its highest levels since 2008. The British Pound is off as the September UK jobs report came in mixed, with wage growth beating expectations and headline jobs growth falling short. Rates markets continue to price in north of a 70% chance of a 25-bps rate hike in November by the BOE, according to overnight index swaps.

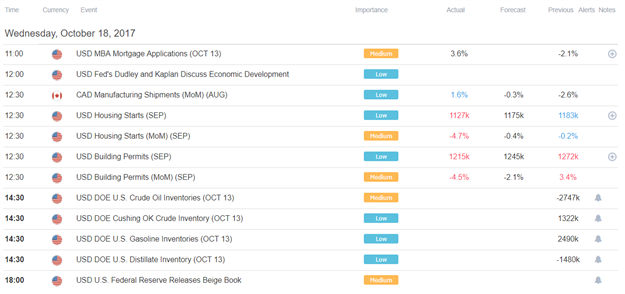

DailyFX Economic Calendar: Wednesday, October 18, 2017 – North American Releases

In what is an apparent theme this week, the North American economic calendar is once again without a ‘high’ importance event on Wednesday. A slew of US housing data from September came in weaker than expected, knocking back the US Dollar on an otherwise positive day. With the remainder of the calendar clear of American- or Canadian-specific data prints, attention turns to the upcoming energy inventories’ releases at 10:30 EDT/14:30 GMT. Later in the session, at 14 EDT/18 GMT, the Fed’s Beige Book for September will be released, which will in turn provide insight into sentiment among the Fed’s regional respondents.

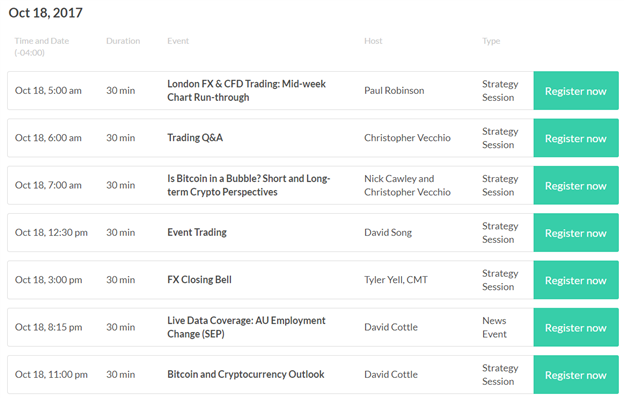

DailyFX Webinar Calendar: Wednesday, October 18, 2017

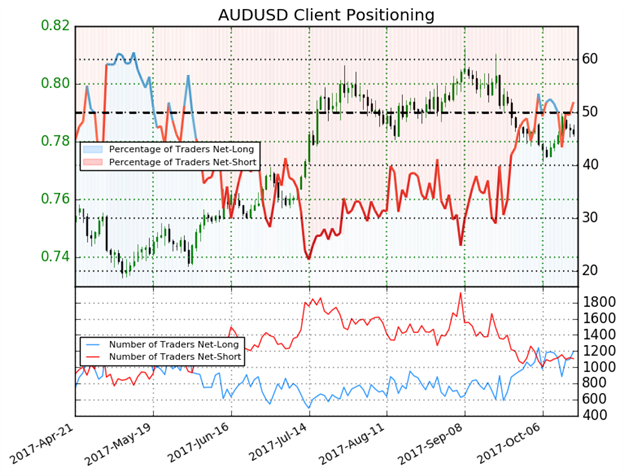

IG Client Sentiment Index Chart of the Day: AUDUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

AUDUSD: Retail trader data shows 52.0% of traders are net-long with the ratio of traders long to short at 1.08 to 1. The number of traders net-long is 6.2% higher than yesterday and 3.8% lower from last week, while the number of traders net-short is 4.7% lower than yesterday and 2.0% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUDUSD trading bias.

Five Things Traders are Reading

- “NZD/USD & GBP/USD One-week Volatility Expectations Highest Among Majors” by Paul Robinson, Market Analyst

- “Technical Outlook for US Dollar, Cross-rates, Gold & More” by Paul Robinson, Market Analyst

- “GBP/USD Remains Weak as UK Labour Market Firms Further” by Nick Cawley, Analyst

- “Euro May Rise as Draghi Speaks, US Dollar Eyes Fed Beige Book” by Ilya Spivak, Senior Currency Strategist

- “Stagnant U.K. Household Earnings to Fuel GBP/USD Weakness” by David Song, Currency Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.