The US Dollar is trading slightly higher today after yesterday’s surge following the Federal Reserve rate decision. While the FOMC kept rates on hold as was widely expected (Fed funds were pricing in a 0% chance of a 25-bps rate hike ahead of time), 1) announcing the commencement of the balance sheet normalization process, otherwise known as the unwind of QE and 2) maintaining their near-term forecasts and ‘dot plot,’ which suggests that another rate hike is on tap for December, was beyond consensus and seen as more hawkish relative to market expectations. Outside engulfing bars appeared in DXY Index, EUR/USD, USD/CHF, and USD/JPY as a result.

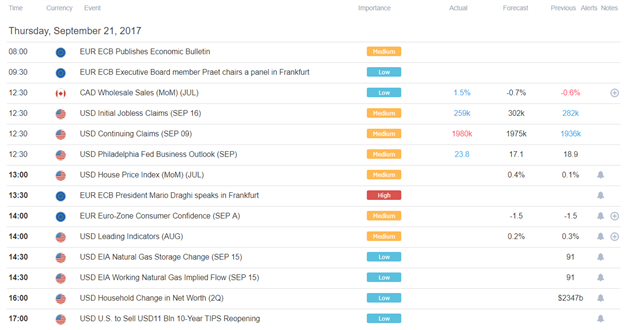

DailyFX Economic Calendar: Thursday, September 21, 2017 - North American Data Releases

The upcoming economic calendar is considerably lighter than yesterday, which featured the high watermark event of the week in the Federal Reserve rate decision. The top event risk for the remainder of the day comes not from North America but from Europe, where European Central Bank President Mario Draghi will be speaking in Frankfurt at 9:30 EDT/13:30 GMT. Earlier this week, rumors swirled that ECB policymakers were considering delaying the tapering of their QE program from October until December; should ECB President Draghi speak to any outstanding issues with monetary policy, heightened volatility in EUR/USD is possible.

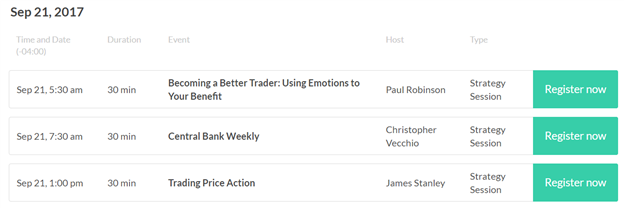

DailyFX Webinar Calendar: Thursday, September 21, 2017

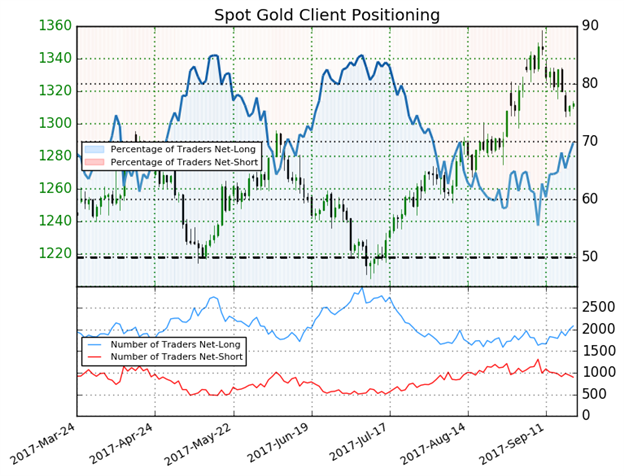

IG Client Sentiment Index Chart of the Day: Spot Gold

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Spot Gold: Retail trader data shows 69.0% of traders are net-long with the ratio of traders long to short at 2.23 to 1. The number of traders net-long is 5.4% higher than yesterday and 6.1% higher from last week, while the number of traders net-short is 7.2% lower than yesterday and 11.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Spot Gold-bearish contrarian trading bias.

Five Things Traders are Reading

- “US Dollar Bottoming Process May Finally Be Starting” by Christopher Vecchio, CFA, Senior Currency Strategist

- “S&P 500 Bulls Undeterred by Hawkish Fed; Eyes on Slope Resistance” by Paul Robinson, Market Analyst

- “Fed Beats Hawkish Drum, Dollar and Risk Tempt Reversal” by John Kicklighter, Chief Currency Strategist

- “Nikkei 225 Technical Analysis: Comfortable At The Heights?” by David Cottle, Analyst

- “Crude Oil Price Hit 4-Month High, Gold Drops on FOMC Outcome” by Ilya Spivak, Senior Currency Strategist