Talking Points:

- Switzerland’s 2Q QoQ GDP at 0.6% vs 0.4% expected

- 2Q year-on-year GDP at 2.0% vs 1.1% revised prior

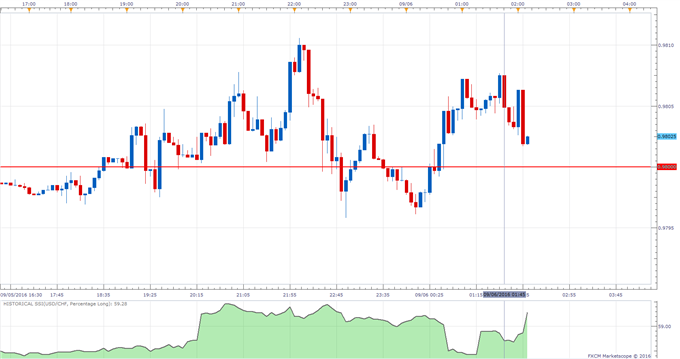

- The Swiss Franc saw a slight positive response versus other majors on the news

If you’re looking for trading ideas, check out our Trading Guides Here

According to estimates released today by the Swiss State Secretariat for Economic Affairs (SECO), Switzerland’s 2Q’16 Gross Domestic Product (GDP) beat expectations.

The QoQ figure printed 0.6%, above the 0.4% quarterly growth expected by economists, and the prior quarter in which the economy grew a revised 0.3%.

The year-on-year change in GDP came well above expectations; the report showed the economy grew at 2.0%, above the expected reading of 0.8%, and the prior revised 1.1% print.

Looking into the report, SECO said that the figures were underpinned by foreign trade as well as government consumption, while household consumption expenditure stagnated, and investment in construction and equipment fell slightly.

Exports of goods rose by 0.8% while imports rose by 0.5%. Exports of services fell -0.1%, and service imports recorded a 1.1% decline.

The SNB will hold its rate decision next week, September 15. The central bank’s deposit rate is already set at negative -0.75% after keeping policy unchanged at the June meeting.

Action by the central bank appears to be widely determined by the ECB decisions in an attempt to keep the EUR/CHF exchange rate in check, as Franc strength could potentially burden on the Swiss economy due to the trading relations between Switzerland and the Euro-Zone. The SNB continues to view the Swiss Franc as significantly overvalued.

Taking this into consideration, the beat to the GDP expectations today appear to have had only a slight positive impact for the Swiss Franc, perhaps due to the limited influence the numbers have on the upcoming SNB monetary policy decision.

The DailyFX Speculative Sentiment Index (SSI) is showing that about 59.2% of traders are long the USD/CHF at the time of writing, implying a short bias on a contrarian basis.

You can find more info about the DailyFX SSI indicator here

USD/CHF 5-Minute Chart: June 1, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni